Overview

We’ll start today’s article by explaining what crypto liquidations are. As such, we’ll ensure you all know the meaning of liquidation in crypto trading. After all, only after you know the answer to “What are liquidations in crypto?” can you take the right steps to avoid them. And that’s exactly what we’ll do next. We’ll go over the key strategies when it comes to avoiding crypto liquidations. Moreover, we’ll particularly focus on the three specific things you should do to avoid experiencing what is known as liquidation in crypto firsthand.

As for the final part of today’s topic, we’ll devote our attention to the best platform among crypto trading tools – Moralis Money. By offering powerful cryptocurrency analysis sites (a.k.a. token pages) and other included crypto analysis tools, this platform can help you easily prevent crypto liquidations. Therefore, you ought to get familiar with this top crypto trading tool sooner rather than later!

What are Crypto Liquidations: Exploring the Meaning of Crypto Liquidations

So, what are liquidations in crypto? Crypto liquidations refer to the process of converting assets, such as leveraged positions or collateral, into cash. This conversion is usually triggered by unfavorable market movements, where the assets’ value drops significantly. It’s worth pointing out that liquidations are nothing new, and they are part of traditional markets as well. However, due to the crypto market’s inherent volatility, coupled with the widespread use of derivatives like margin trading and futures, crypto liquidations have become more common and more pronounced.

There are various types of liquidation in crypto trading, both voluntary and forced. Each impacts traders differently based on their risk exposure and market conditions.

Now, to properly understand the answer to the question “What is liquidation in crypto?” you need to be familiar with some basic concepts. For instance, you need to know how margin works in crypto, what leverage trading is, and why traders use it. So, let’s quickly go over these essentials together.

How Does Margin Work in Crypto?

Margin trading in crypto involves borrowing funds to increase the size of a trading position. So, when traders engage in crypto margin trading, they essentially leverage borrowed capital. This allows them to amplify their exposure to crypto assets without the need for the total value of the position.

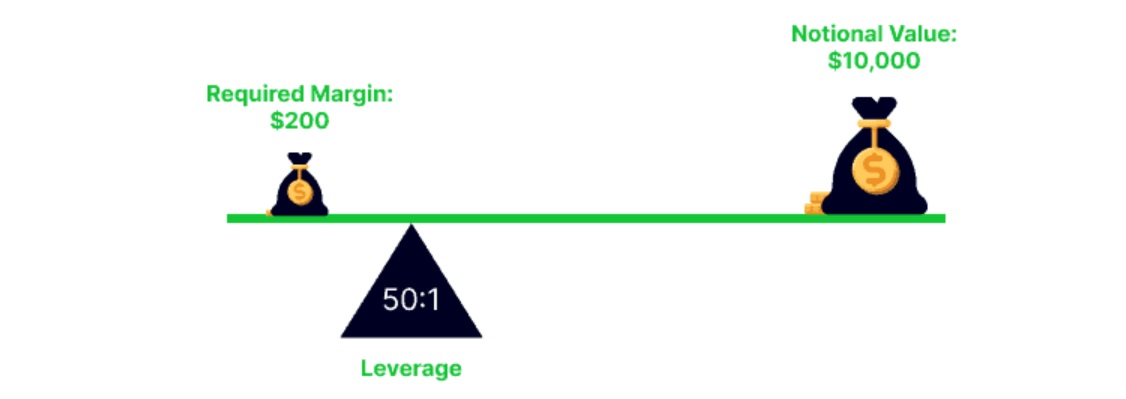

Crypto exchanges (mainly centralized ones – CEXs) typically require traders to deposit an initial margin. You can think of it as a security deposit; after all, it is a prerequisite for opening a leveraged position. This initial margin serves as collateral and provides a safety net for the exchange in case the trade goes against the borrower.

As the above image indicates, margin trading cryptocurrencies can enhance potential profits. However, it also increases risk by magnifying potential losses, and this is where knowing what liquidations are in crypto comes into play. After all – unlike in spot trading – with margin trading, one can much more easily lose everything. Hence, traders must understand the mechanics of margin and use it with caution to manage risk effectively.

What is Leverage Trading, and Why Do Crypto Traders Use Leverage?

Leverage trading is the same as margin trading; it just uses a different name. We already explained above that margin refers to the amount of money one needs to open a position. On the other hand, leverage refers to a multiplier of that deposit.

For instance, let’s say you have $100 and decide to trade that amount. That would be your margin. Depending on the trading pair and exchange in question, you can then use a leverage size that suits your risk tolerance. So, let’s say you go with 3x leverage. This would give you the same power as if you were to have $300. However, this means that every move of the price is now multiplied by that factor. As such, a 1% move in either direction would mean a 3% for your trade.

This amplification is obviously great if the trade goes in the direction you bet on. However, it is “leverage-times” worse when it goes in the opposite direction. It is in these types of situations that new traders experience liquidations in crypto.

Nonetheless, crypto traders use leverage to amplify the potential returns on successful trades. Moreover, experienced traders use that leverage to minimize their risk by entering trades with lower positions. On the other hand, inexperienced traders typically significantly increase their risk by applying leverage.

When Does Liquidation in Crypto Trading Occur, and How Do Crypto Liquidations Happen?

In the realm of cryptocurrency trading, liquidation occurs when a trader cannot maintain a leveraged position due to insufficient funds. This inability to meet margin requirements prompts exchanges or lending platforms to forcibly close the position to prevent further losses. As such, crypto liquidations serve as a risk management mechanism for exchanges and lenders.

So, to avoid forced liquidations, it’s essential for traders to understand the conditions that lead to liquidation and implement risk mitigation strategies to avoid trades that come with the risk of crypto liquidations altogether.

What is the Liquidation Price?

The liquidation price in crypto trading is the price at which a trader’s leveraged position will be automatically closed by the exchange to prevent further losses. The liquidation price is determined by the level at which the trader’s losses would equal the initial margin deposited (minus the fees).

Two Main Types of Crypto Liquidations

Crypto liquidations come in different forms, with each type serving a specific purpose. For instance, partial liquidation involves closing a portion of a trading position. This happens before the entire initial margin is depleted, offering a chance to offset losses.

On the other hand, total liquidation in crypto trading occurs when the entire initial margin is used up. This results in the closure of the entire position.

Forced liquidation, whether partial or total, is initiated by the exchange or lending platform when a trader fails to meet margin requirements.

How to Avoid Liquidation in Crypto Trading

By this point, you should be able to confidently answer the question, “What is liquidation in crypto?” However, in case you’re not yet certain what liquidations in crypto are, make sure to cover the above sections again. After all, a proper understanding of this unpleasant phenomenon is the first step in successfully avoiding crypto liquidation.

All in all, avoiding liquidation in crypto trading is crucial for preserving capital and ensuring long-term success. Fortunately, traders can deploy various strategies and tools to mitigate the risk of liquidation in crypto and protect their investments.

The most obvious method of avoiding crypto liquidations is to stay clear from leverage trading unless you are an experienced trader. However, if you decide to use margin trading, then be sure to employ the three things covered below.

3 Things to Avoid In Order to Not Become Liquidated

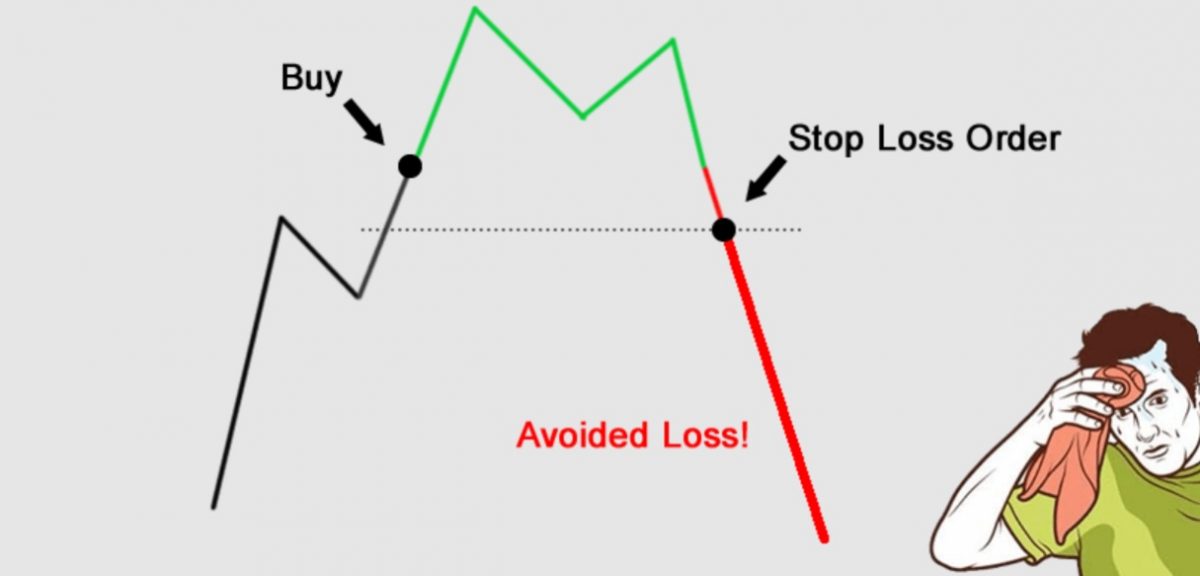

- Implement Stop Losses Effectively – Using stop loss (SL) orders is a core strategy to prevent liquidation in crypto trading. By setting clear SLs above liquidation prices, you get to establish levels where your cryptos will be sold automatically. This limits potential losses. However, it’s essential to find a proper balance between setting a stop loss too close to the entry point and placing it too far. This is why determining the risk-to-reward (RR) ratio is very important.

- Manage Leverage and Position Sizing – One of the key contributors to liquidation risk is excessive leverage. Traders should carefully manage their leverage ratios and position sizes to align with their risk tolerance. It’s extremely important to keep your understanding of liquidations in crypto in mind and select your position sizing and leverage accordingly.

- Stay Informed and Monitor Market Conditions – Vigilant monitoring of market conditions, especially during periods of heightened volatility, is essential. You should pay attention to factors such as open interest, support and resistance levels, and overall market sentiment. Being informed about potential market movements allows for proactive decision-making and timely adjustments to trading strategies, reducing the likelihood of liquidation.

Avoid Liquidation in Crypto Trading: Use Moralis Money

First of all, let’s remind you of the fact that the average altcoin tends to increase in value by 50x-70x during a bull market. As such, even without using leverage, there are countless opportunities for massive gains. However, you need to be able to spot altcoins with promising potential to position yourself properly for those massive returns.

Fortunately, finding the best altcoin opportunities is one of Moralis Money’s specialties. This pinnacle among blockchain analytics tools offers a special feature: Token Explorer. Moralis Money’s Token Explorer serves, for example, as the best crypto scanner. It allows you to run predefined or unique strategies with just a couple of clicks. In return, it generates a dynamic list of tokens with potential.

Furthermore, this core feature incorporates additional functionalities, including advanced security checks. These allow you to avoid scammy tokens. Plus, Token Explorer also comes with an automation feature, which enables you to run your strategies on autopilot. As such, you create your own crypto pump detector.

When you use Moralis Money, you can avoid crypto liquidations by focusing on spot trading. You also get several powerful tools that can help you implement the above-covered three things to avoid becoming liquidated.

Using Moralis Money to Assess the Market Sentiment and More

Starting with the crypto bubblemaps on the platform’s homepage, Moralis Money provides you with a clear and intuitive way of keeping an eye on the crypto market. This free feature lets you immediately spot daily winners and losers among the top 500 coins by market cap. For users that opt for the Pro or Starter plans, the platform also offers crypto bubbles that indicate altcoins that are gaining momentum (a.k.a. “Top Tokens On The Move” option).

Speaking of Moralis Money Starter and Pro users, they also get to enjoy the best crypto charting tool: Money Line!

With Money Line in your corner, you can easily spot market conditions on all timeframes. This indicator provides you with signals regarding trend reversal, which may serve as buy/sell alerts. Money Line also incorporates its cloud feature, which indicates key levels of support and resistance.

Consider Live Prices, On-Chain Metrics, and DYOR

Moralis Money’s token pages enable you to research individual tokens. These pages also provide you with invaluable, easy-to-interpret insights into altcoins’ live prices, token distribution, smart contract security aspects, and real-time, on-chain metrics. Plus, as a Moralis Money Starter or Pro user, you can use these pages to set specific alerts for the token in question. These alerts enable you to monitor price and on-chain changes on autopilot, warning you when it’s time to act.

Essentially, if you start using the insights that Moralis Money offers and combine that with the above info about liquidations, you will significantly improve your chances of success and avoid any future crypto liquidations.

To experience the power of Moralis Money firsthand, use the top menu bar to access any of the platform’s features. Or, get going via the interactive widget below:

What is Liquidation in Crypto and How Can You Avoid It? – Key Takeaways

- What is liquidation in crypto? It is when an exchange or lending provider’s safety mechanism automatically sells a trader’s position to avoid further loss.

- Crypto liquidations come into play with margin/leverage trading.

- If you avoid this type of trading, you take liquidation risks out of the equation.

- If you decide to employ this type of trading, you should first make sure you have a proper understanding of liquidations in crypto. Plus, you should also implement stop losses, manage leverage and position sizing, and monitor market conditions effectively.

- Whether you wish to focus on spot or leverage trading, Moralis Money is one of the best tools you can use. It allows you to spot crypto opportunities, offers market sentiment insights, tokens’ live prices and real-time, on-chain metrics, and many other powerful tools.

- To unlock Moralis Money’s full potential, you want to opt for its Pro or Starter plan. By doing so, you also get your hand on the best crypto indicator: Money Line.

2023 was a great recovery year for crypto as a whole. After a bearish 2022, in January 2023, Bitcoin started to move up and so did many altcoins. After a turbulent summer, most tokens finished the year strong. However, aside from some extremely well-performing tokens, such as $INJ and $SOL, many cryptocurrencies still haven’t made their true “bull market” moves. As such, now is still a great time to implement the knowledge offered by this article. So, start using Moralis Money and finally become a successful crypto trader!