We’ll begin our article with an overview of the Goldfinch crypto project. Once we establish the basics, including answering “What is Goldfinch crypto?” we’ll dive deeper into the topic. This includes exploring the project’s history, operational mechanisms, and avenues for a more complete understanding of Goldfinch. As we move forward, our focus will shift to Goldfinch crypto loans, clarifying their nature, target audience, and significance as the protocol’s backbone. Additionally, we aim to familiarize you with the GFI crypto asset, offering insights into its purpose, tokenomics, and an assessment of its overall viability.

Recognizing that many, like ourselves, are primarily interested in altcoin investing, we will incorporate a GFI price analysis within this Goldfinch crypto review. Beyond examining the token’s historical price trends, we will employ technical analysis (TA) fundamentals to identify key support and resistance levels. Furthermore, we will provide a speculative Goldfinch crypto price prediction. That said, to enhance your decision-making process, we will guide you on leveraging the capabilities of Moralis Money, empowering you to determine opportune moments for acquiring the GFI crypto token. For those contemplating a GFI purchase, we will also outline where you can find the best market for you.

Full Goldfinch Crypto Review: What is Goldfinch Finance?

Goldfinch Finance is a groundbreaking decentralized lending platform that’s reshaping the landscape of crypto loans. Unlike most other platforms, Goldfinch eliminates the need for borrowers to over-collateralize their loans with on-chain assets.

Goldfinch’s unique credit model, “trust through consensus,” sets it apart. The latter evaluates borrowers’ creditworthiness based on their past behavior. Furthermore, the platform accepts off-chain assets and income as collateral, marking a significant departure from the crypto lending norm.

By connecting investors, backers, liquidity providers, borrowers, auditors, and members in its ecosystem, Goldfinch opens doors to global capital while ensuring efficient local loan servicing. This innovative approach makes Goldfinch a potential game-changer in the world of decentralized finance, offering a win-win for both borrowers and investors.

History of the Goldfinch Crypto Protocol

The idea of Goldfinch crypto loans became possible after the project’s launch in July 2020. This was when two former Coinbase employees, Mike Sall and Blake West, initiated Goldfinch’s hybrid DeFi protocol.

The Goldfinch crypto protocol emerged as a revolutionary force in the decentralized lending space. The platform went live with the mission of transforming the DeFi lending landscape by introducing a novel credit model known as “trust through consensus.” This model, which evaluates borrowers’ creditworthiness based on their historical behavior, sets Goldfinch apart from its peers.

The founders aimed to create a decentralized lending ecosystem that enables borrowers worldwide to access affordable loans without the need for over-collateralization with on-chain assets.

As of April 2023, Goldfinch has facilitated active loans valued at over $100 million, showcasing its rapid growth and impact on the crypto lending industry.

As for the intriguing choice of the name “Goldfinch,” it remains a bit of a mystery. While only the founders can shed light on the exact inspiration behind the name, several possibilities come to mind. For instance, the American goldfinch is known for its vibrant colors and is often associated with prosperity and good fortune. This symbolism could align with Goldfinch’s mission of bringing accessible lending options to businesses worldwide. Additionally, the goldfinch is a migratory bird, reflecting the platform’s global reach and its focus on emerging markets.

How Does Goldfinch Work?

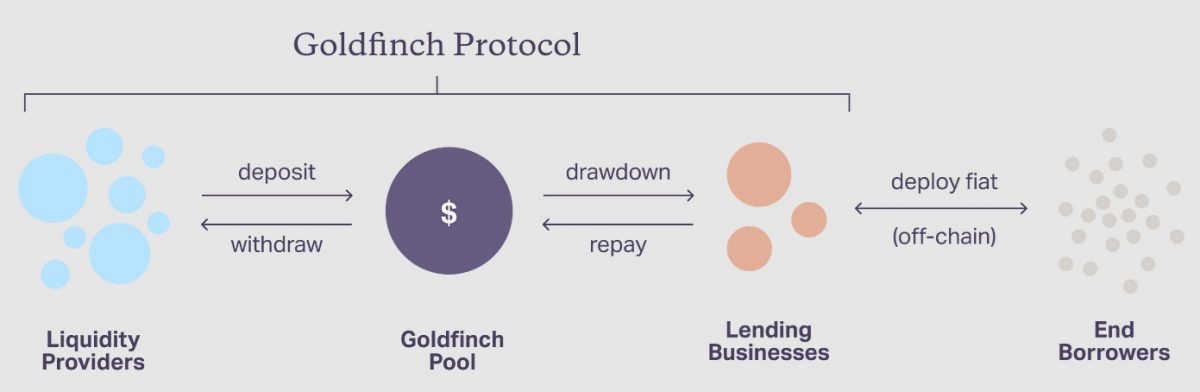

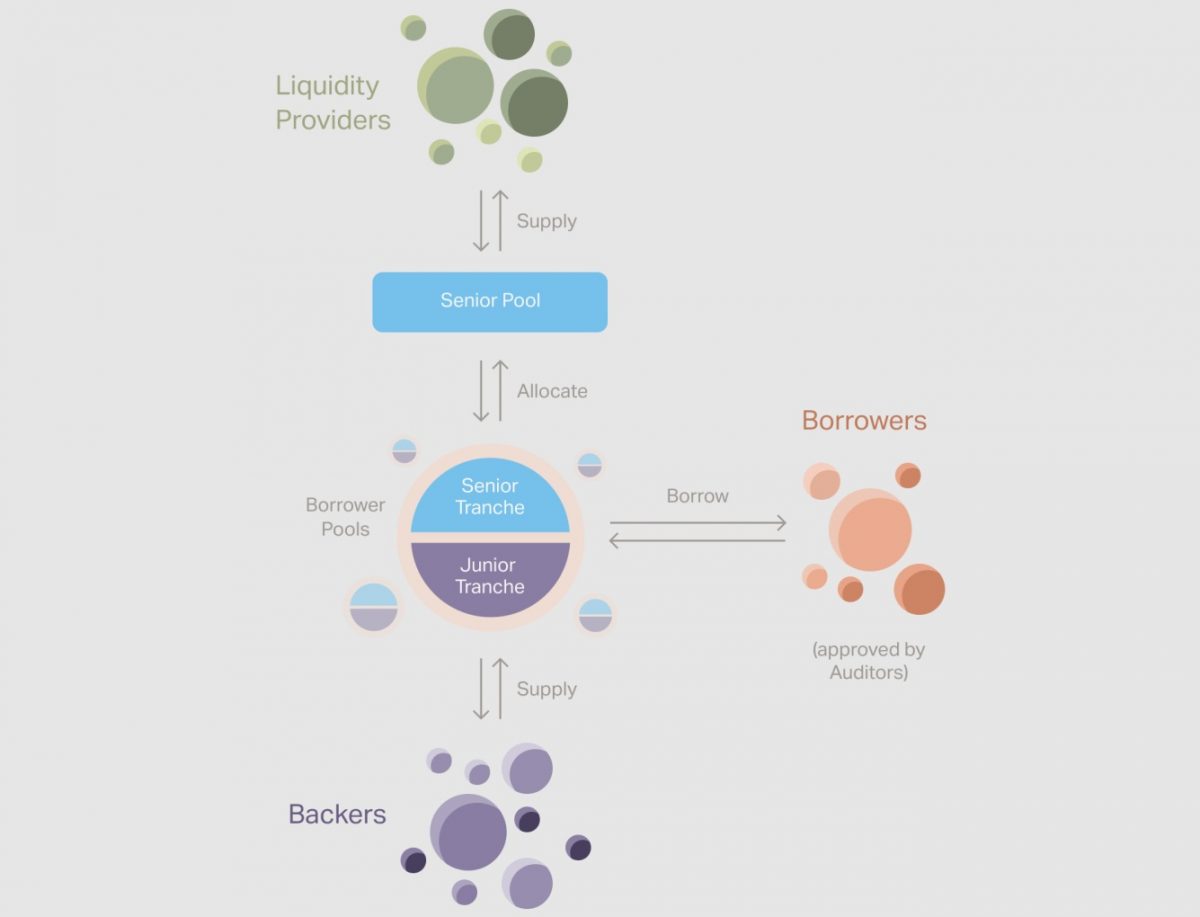

Goldfinch operates as a decentralized lending protocol with a groundbreaking approach to credit. As mentioned previously, the platform introduces a distinctive credit model termed “trust through consensus.” This model leverages collective participant actions, avoiding reliance on individual backers or auditors. Furthermore, the protocol’s ecosystem comprises key players: investors (backers and liquidity providers), borrowers, auditors, and members.

Borrowers propose credit lines through borrower pools, detailing terms like interest rates and repayment schedules. Investors supply stablecoins (like USDC) either as backers providing first-loss capital directly to borrower pools or as liquidity providers contributing second-loss capital to the senior pool, allowing for automatic allocation based on backers’ assessments.

Critical to Goldfinch’s philosophy is “trust through consensus,” which builds on the collective wisdom of the community. The more backers supporting a borrower pool, the higher the leverage ratio from the senior pool. Auditors also play a pivotal role. After all, they vote to approve borrowers and safeguard against fraudulent activities.

Goldfinch’s two-token model involves the GFI crypto for governance and FIDU representing a liquidity provider’s deposit in the senior pool. These tokens adhere to the ERC-20 standard.

Note: If you wish to explore the topic “What is Goldfinch crypto?” more deeply, make sure to visit the project’s official website. There, you’ll find the links to the project’s whitepaper, documentation, and other outlets.

This Goldfinch crypto review wouldn’t be complete without taking a closer look at Goldfinch crypto loans. After all, this is the core service of the protocol. So, let’s move further by exploring crypto loans from Goldfinch in the next section!

What are Goldfinch Crypto Loans?

Goldfinch crypto loans allow lenders to earn interest and borrowers to gain access to capital. As explained above, Goldfinch’s unique credit model evaluates borrowers’ creditworthiness through their past behavior. This allows for a broader spectrum of lending on-chain. Moreover, the platform stands out by facilitating the complete collateralization of loans with off-chain assets and income. This approach ushers in a paradigm shift for borrowers who might lack sufficient on-chain collateral.

Designed to cater to businesses worldwide, Goldfinch’s borrowers already span more than 28 countries. Some of its leading deals include the following:

- PayJoy in Mexico

- QuickCheck in Nigeria

- Divibank and Addem Capital in Latin America

- Greenway through Almavest in India

- Cauris in Africa, Asia, and Latin America

Essentially, the protocol connects investors (backers and liquidity providers) with borrowers, providing efficient and effective local loan servicing.

How to Lend/Borrow Goldfinch Crypto Loans

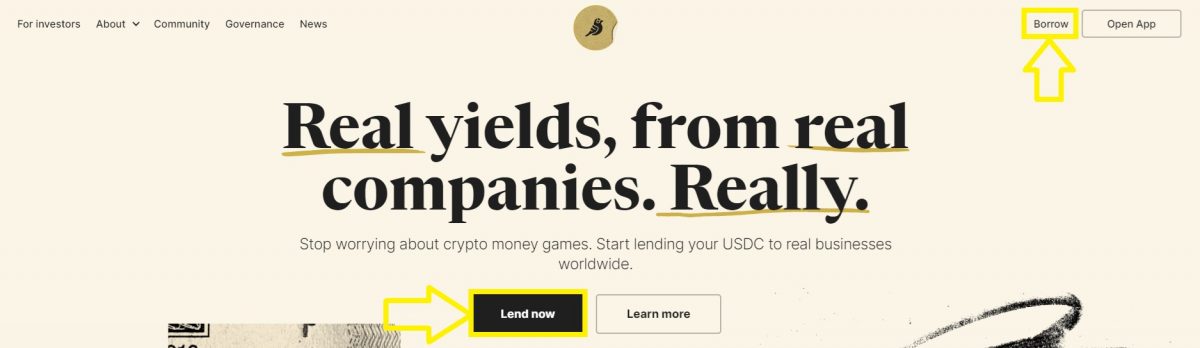

If you wish to become a loan provider or a borrower of Goldfinch crypto loans, visit the project’s official website. There, you will see the “Borrow” and the “Lend now” buttons:

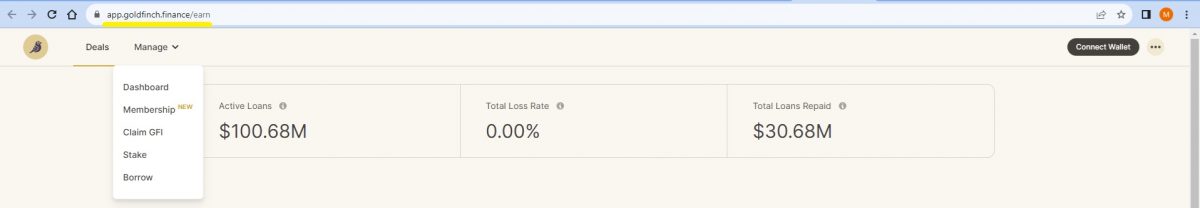

Of course, you can also access the protocol’s application via the above “Open App” button, which will take you to the Goldfinch dashboard:

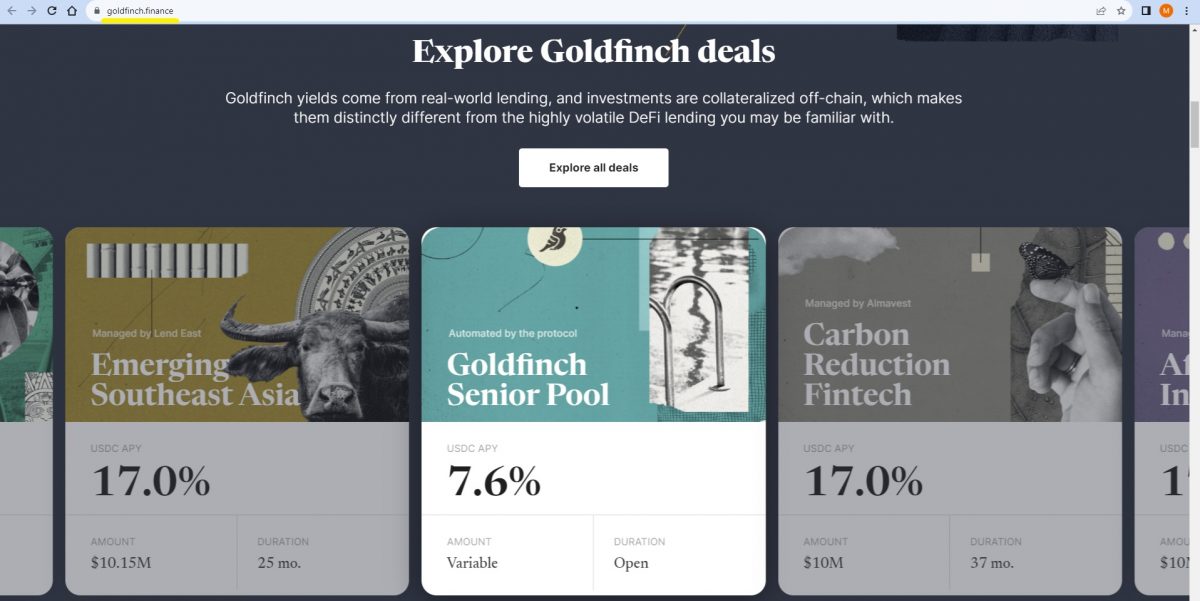

By scrolling down the page, you get to explore the “Explore Goldfinch deals” section:

Understanding GFI’s role, purpose, and distribution is key to appreciating the depth of Goldfinch Finance’s decentralized lending ecosystem. Without these insights, you can’t fully grasp what Goldfinch crypto is. As such, let’s dive into the GFI crypto in the following section!

What is the GFI Cryptocurrency? Exploring the GFI Crypto

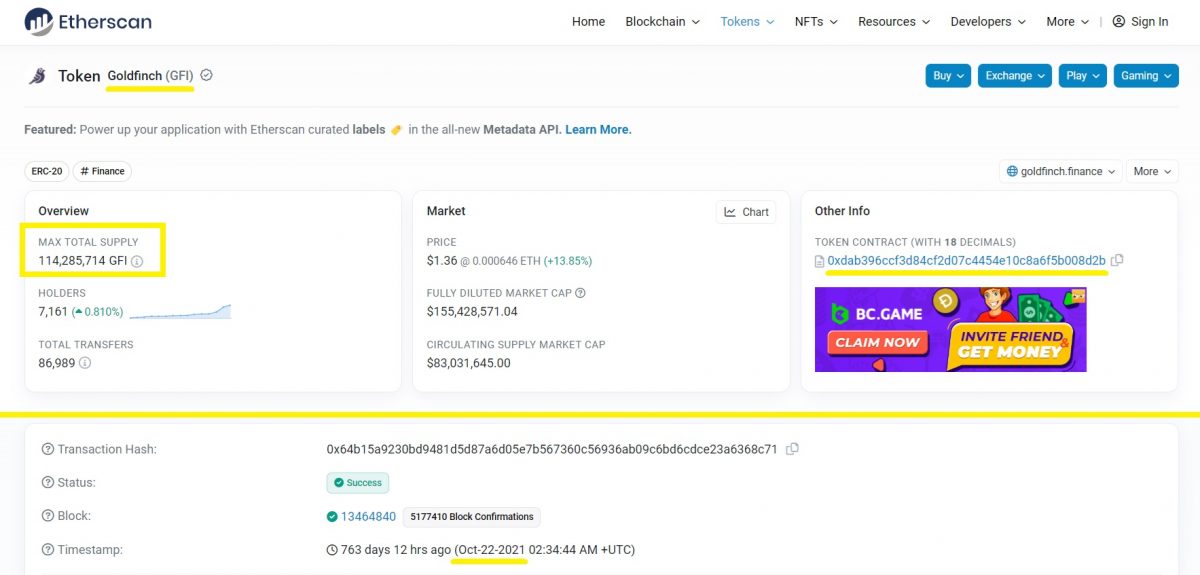

Goldfinch’s native cryptocurrency, GFI, is at the core of the Goldfinch Finance ecosystem. The GFI crypto asset lives on the Ethereum blockchain, following the ERC-20 token standard. The token was minted on October 22, 2021.

As the protocol evolves, GFI remains a cornerstone token, empowering participants and fostering a global, accessible, and community-driven approach to decentralized finance.

Purpose and Use Case

Launched with an initial capped supply of 114,285,714 tokens, GFI plays a pivotal role in governing the decentralized protocol. Liquidity providers, backers, auditors, borrowers, contributors, and the broader community have designated allocations, showcasing Goldfinch’s commitment to a balanced and inclusive distribution.

So, GFI serves a multifaceted purpose within the Goldfinch ecosystem. For liquidity providers, it’s a means of participating in liquidity mining and earning incentives. Backers engage with the GFI crypto through Goldfinch Flight Academy, backer pool liquidity mining, and future staking endeavors.

Tokenomics

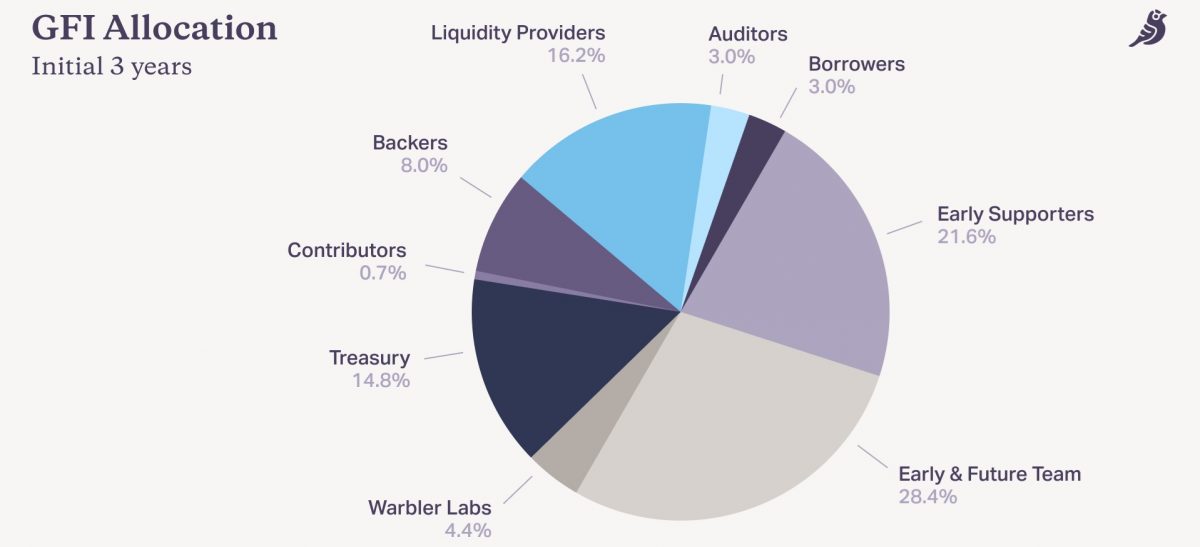

Goldfinch’s tokenomics reflects a meticulous distribution strategy. Initially, liquidity providers held 16.2% of the total supply, with specific allocations for early liquidity provider programs and ongoing liquidity mining.

On the other hand, backers accounted for 8%, distributed among Flight Academy, backer pool liquidity mining, and upcoming backer staking. Moreover, auditors, borrowers, and contributors each have 3% allocations, emphasizing the protocol’s commitment to transparency and community involvement.

Furthermore, the community treasury, holding 14.8%, empowers the community to make decisions regarding protocol adjustments and grants. The early and future team, Warbler Labs, and early supporters rounded out the distribution, aligning incentives across a diverse array of stakeholders. For a clearer overview of the initial GFI allocation, see the image below.

Here’s the gist of GFI’s tokenomics:

- Token name: Goldfinch Token

- Symbol/ticker: GFI or $GFI

- Network: Ethereum

- Token type: ERC-20

- Smart contract address: 0xdab396ccf3d84cf2d07c4454e10c8a6f5b008d2b

- Total supply: 114,285,714 $GFI

- Initial allocation:

- Liquidity providers 16.2%

- Auditors 3.0%

- Borrowers 3.0%

- Early supporters 21.6%

- Early and future team 28.4%

- Warbler Labs 4.4%

- Treasury 14.8%

- Contributors 0.7%

- Backers 8.0%

Is Goldfinch (GFI) Crypto Good?

At this point, Goldfinch crypto loans and the entire project seem legit. So, as long as this is the case, the GFI token has the potential to attract additional investors. However, it is worth pointing out that as a governance token, GFI doesn’t have built-in mechanisms that would drive its price higher. Of course, a lot of buy pressure can still come from altcoin traders.

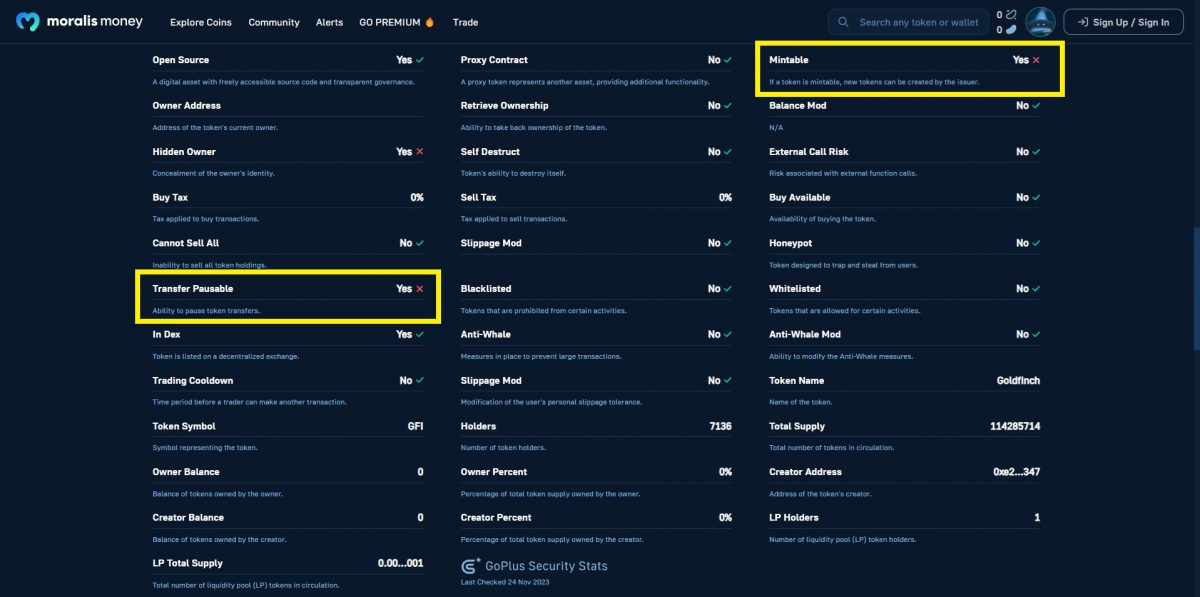

One noteworthy thing is the GFI’s smart contract. In fact, the security check of the asset’s smart contract reveals some potential issues:

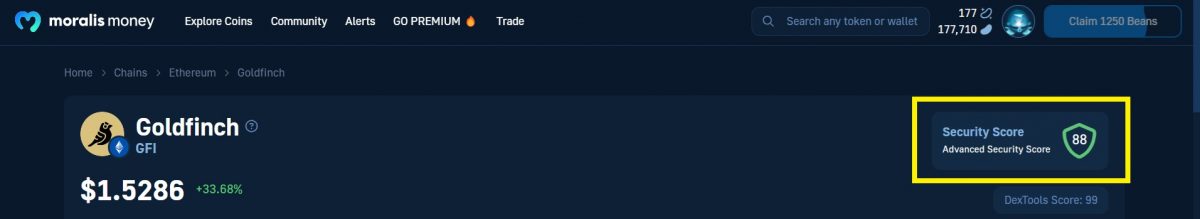

So, while the asset has a current total supply, its smart contract allows the creation of additional instances of $GFI. Also, the smart contract admins can pause any GFI transfer, giving you less control over the token. However, Moralis Money’s advanced security score for the Goldfinch coin is 88 out of 99, which is not at all bad:

Goldfinch (GFI) Price Analysis

Now that you know what the Goldfinch crypto project and GFI token are all about, it’s time we take a closer look at the asset’s price. The following weekly chart on the logarithmic scale includes the entire GFI crypto price action so far:

Looking at the above chart, you can instantly see that the $GFI price was in a clear downtrend right after its launch. Following the initial spike to as high as $43 on Coinbase, the asset’s value started to plummet.

Of course, this didn’t happen in a straight line. In fact, there were several relief rallies, some as high as 250%. However, it wasn’t until June 19, 2023, that $GFI crypto reached its bottom. On that day, the token set its all-time low (ATL) at $0.2869.

Following that low, the coin started to recover and even crossed $0.50 on July 5, 2023. But the momentum at the time wasn’t strong enough for GFI to get a daily close above that level. Instead, it spent the next four months or so in the $0.31 – $0.48 range.

However, after the third revisit of the bottom of the aforementioned range, the asset started a new rally on October 19, 2023. The token experienced some resistance around $0.43 but eventually managed to break above that level and even move beyond $0.50. In fact, this run is still going on at the time of writing – the GFI price reached as high as $1.83 today (November 21, 2023).

TA (Technical Analysis)

Using the basics of TA, we’ve outlined the key support and resistance levels. The most significant ones are around these levels:

- $0.32

- $0.52

- $0.70

- $1.34

- $2.11

- $4.64

As you can see in the above daily chart, the GFI crypto token is currently battling with the resistance of around $1.34. However, it’s worth pointing out that the price wicked all the way up to $1.83. Moreover, if you take a closer look at the above chart, you should also see an uptrend line supporting the recent rally. During the ongoing run, the asset experienced an increase in trading volume, which is a bullish sign.

Aside from the above TA basics, we also used the Money Line indicator, which is flashing the “Bullish” signal on both daily and weekly timeframes:

Note: By signing up for the Moralis Money Starter or Pro plan, you can access the Money Line indicator for free!

Full Goldfinch Crypto Price Prediction

Please keep in mind that crypto price predictions are highly speculative and can often be misleading. As such, make sure to take our Goldfinch crypto price prediction with a grain of salt. Generally speaking, however, a token’s key levels of support (S) and resistance (R) may serve as price targets. So, by looking at the above charted S/R levels, we already have some Goldfinch crypto price prediction targets.

Given that there is no bearish RSI divergence and the assets trading volume is increasing, $2.11 is our short-term Goldfinch crypto price prediction. However, if the asset were to lose momentum or if BTC were to pull back, a retest of $0.70 would be more likely.

Instead of relying on our predictions, we recommend using the Moralis Money $GFI token page below to access the asset’s live price and real-time, on-chain metrics.

Speculative Forecast

Since the GFI crypto started trading just after the previous bull market, meaning it has only been around in a bearish market, we believe the upcoming bull run could push $GFI into its new all-time high (ATH). Of course, only time will tell how high the GFI price will go.

However, using the Fibonacci retracement tool, the most optimistic level (the “4.236” extension) points to $180. Do you think that $GFI can go that high? Well, given its current market cap of $78.8 million, it is not impossible.

Still, we recommend you rely on your own short-term Goldfinch crypto price predictions using the above-mentioned real-time price and on-chain data.

Should You Buy GFI Tokens?

Since we are not financial advisors, we cannot answer the above question on your behalf. However, using the above sections, you should be able to decide whether or not you find the idea of Goldfinch crypto loans interesting or not. If yes, then you ought to research the project and the GFI crypto token further before buying it.

Fortunately, you can do this quite easily via the Moralis Money Goldfinch ($GFI) token page. You’ll find all the resources and tools you need to decide if/when to buy $GFI on that page. You should particularly focus on the asset’s live price compared to its historical price action. Then combine that with the token’s real-time, on-chain metrics (a.k.a. alpha metrics).

So, to answer the above question with confidence, follow the “$GFI” link or use the interactive widget below:

Where to Buy GFI?

If you decide you wish to get a bag of $GFI, you have several options. Just use the “Market” section on CoinGecko or CoinMarketCap page for that token. There, you’ll find a list of all CEXs and DEXs that offer the relevant training pair, including the trading volume. As such, you can easily pick a market that best suits your goals.

Goldfinch Crypto Review – Key Takeaways

In this Goldfinch crypto review, some of the questions we answered were “What is Goldfinch crypto?” and “What are Goldfinch crypto loans?” In addition, you learned what the GFI crypto token is all about.

Here are the key takeaway points:

- Goldfinch crypto loans, powered by Goldfinch’s DeFi protocol, are all about facilitating global, inclusive, and community-powered lending and borrowing in the decentralized finance (DeFi) space.

- Goldfinch was founded by two former Coinbase employees in 2020.

- The GFI crypto token is the governance token for the Goldfinch protocol.

- Everyone can freely trade the $GFI coin.

- To determine if/when to buy GFI, use the Moralis Money $GFI token page. It also provides you with the asset’s live price and real-time, on-chain metrics, which you can use to come up with your own Goldfinch crypto price prediction at any time.

If you are interested in making money with altcoins, then make sure to look beyond $GFI. After all, there are countless other altcoin opportunities. And thanks to Moralis Money, you can spot them with just a few clicks or even on autopilot. So, get going with Moralis Money’s core feature – Token Explorer – today. It is the key to deploying the best crypto trading strategies and finally becoming a successful crypto trader.

It’s time you get your hands on the best crypto insights and finally discover the secrets to finding the next coin to blow up!