Crypto Trading Strategies – Overview

There are quite a few crypto trading strategies for beginners as well as for advanced traders. That said, sticking to the more basic crypto trading strategies presented in this article makes sense if you recognize yourself as a beginner trader. Then, as your knowledge and skills evolve, you can progress to more advanced methods.

Also, one thing to point out is that there are different types of crypto trading paths, each with its own strategy. For example, there’s long-term trading and day trading. As a rule of thumb, all crypto day trading strategies are, in most cases, more advanced. They typically require more time and knowledge from traders and the need to apply strict risk management.

Now, as we move forward in this article, we’ll first outline the best crypto day trading strategies since these are the most popular ones. Next, we’ll focus on top crypto trading strategies on larger timeframes, which are good for beginners. Our top strategies in that category are HODLing, dollar-cost averaging, and swing trading.

You’ll also get to learn about the benefits of crypto trading in today’s article. Plus, we’ll review mistakes beginners and pros make when trading crypto. After all, highlighting these common mistakes is the first step to avoiding them.

Last but not least, we’ll share three essential crypto trading strategies you ought to know about in order to not miss out on massive gains. This is where Moralis Money – the ultimate on-chain analysis tool and altcoin finder – enters the stage!

Crypto Day Trading Strategies

The three most common day trading strategies for cryptocurrency include:

- Range Trading

- Scalping

- Momentum Trading

Let’s explore more about each of these in the following sections!

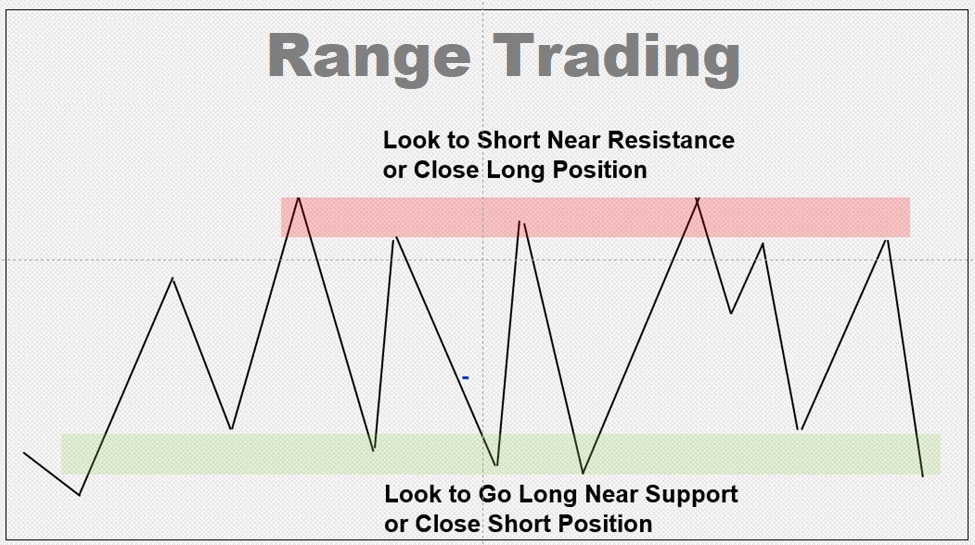

Range Trading

Crypto range trading is a strategy where traders identify specific price levels a crypto asset’s price is expected to trade within. Out of all crypto day trading strategies, this method is highly popular, and it lets traders focus on lower timeframes (ten-second, minute, and hourly charts). On larger timeframes, this method is a solid crypto trading strategy for beginners as well as pros.

To start range trading crypto, one must first choose a cryptocurrency token or pair to focus on. Next, they must analyze historical price data to identify support and resistance levels.

Once traders have identified these levels, they set their buy orders near the support level and their sell orders near the resistance level. Of course, they use risk management tools like stop-loss orders to protect their investment.

Scalping

Scalping is one of the most advanced trading strategies in the crypto market. It involves making quick and smaller trades to profit from minor price fluctuations. However, experienced players often use high leverage to increase profits with this strategy.

As you can imagine, scalping requires constant market monitoring and advanced skills. Thus, it is not suitable for beginners. However, this type of fast-paced trading can be extremely profitable if done correctly, so it’s definitely a crypto trading strategy you want to have in the pipeline of things to learn!

Traders that deploy the scalping strategy in crypto trading choose highly liquid cryptocurrency pairs with low trading fees. They then monitor short-term price charts, such as one-minute or five-minute intervals, to identify short-lived price movements. Next, they set tight profit targets and stop-loss orders to minimize risks.

Successful crypto scalping requires a lot of discipline, a very reliable internet connection, and the ability to make quick decisions. It’s also important to be extra cautious about the transaction costs when deploying scalping, as fees can add up quickly.

Momentum Trading

Momentum trading in crypto is a strategy that involves buying/selling cryptocurrencies that have shown strong price trends. Just like range trading, the crypto momentum trading strategy is not exclusive to intraday trades. It can easily be used on larger timeframes. As such, it’s a valid crypto trading strategy for beginners as well as professionals.

All in all, the momentum approach aims to capitalize on the continuation of existing price movements.

So, this strategy starts by identifying cryptocurrencies that have exhibited strong upward or downward price momentum. Then, traders use TA to confirm the momentum’s strength. Once they identify a cryptocurrency with strong momentum, traders enter a trade in the direction of the trend.

In general, all crypto trading strategies for beginners deploy momentum trading. After all, the “trend is your friend” rule is one of the first lessons most trading guides teach.

Long-Term Crypto Trading Strategies

Before we move any further, it’s important to point out that “long-term” in crypto isn’t necessarily the same as in the traditional markets.

However, in general, due to the extra fast-paced nature of cryptocurrencies, “long-term” often entails anything that isn’t intraday trading. However, most crypto traders would agree that the most common “long-term” timeframes in crypto span over weeks and months, rarely over 18 months.

The top three crypto trading strategies that we will cover in the following sections include:

- HODLing

- Dollar-Cost Averaging (DCA)

- Swing Trading

Just like with the above-covered crypto day trading strategies, the following strategies can be combined. Plus, some of them can also be used for day trading purposes.

HODLing

HODL, or HODLing, derived from the misspelled word “hold,” is a long-term investment/trading strategy in the crypto market. It involves buying cryptocurrencies and holding them in a Web3 wallet for an extended period, regardless of short-term price fluctuations.

It is one of the most popular crypto trading strategies for beginners. After all, HODLing is a straightforward and less stressful approach to crypto investing. Still, to make the most of this strategy, proper timing is key!

Anyone can start HODLing by choosing well-established cryptocurrencies with strong fundamentals. Bitcoin and Ethereum are the most common options. However, the HODL approach can be extremely profitable when used with up-and-coming altcoins in combination with the understanding of crypto cycles. In that case, you HODL throughout the bull market and aim to sell as near the top as possible.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) is another popular crypto trading/investing strategy. It definitely deserves a spot among the basic crypto trading strategies for beginners.

Its passive nature eliminates a lot of guesswork, especially when the most strict DCA method is deployed. The latter involves investing a fixed amount of money at regular intervals, regardless of the cryptocurrency’s price.

This strict DCA approach is obviously far from the most optimal strategy. As such, even beginners should consider DCA in combination with market cycles. So, for optimal results, traders can DCA in the early stages of the bull market and DCA out in the final stages of the bull run.

Anyone interested in implementing DCA needs to decide on a fixed amount of money they are comfortable investing regularly, such as weekly or monthly. Next, they need to choose a cryptocurrency or a diversified portfolio of cryptocurrencies to invest in.

Other specific DCA tactics can also include buying every dip, buying a specific price level, etc.

Swing Trading

“A picture is worth more than a thousand words.“ So, just by looking at the above image and keeping the previous quote in mind, you instantly understand the gist of swing trading. It’s also worth pointing out that swing trading is one of the top crypto trading strategies for beginners. However, it is often deployed by professionals as well.

By strict definitions, swing trading focuses on capturing short to medium-term price swings within the crypto market. It is sort of a middle ground between day trading and long-term investing. Also, with proper timing, it can offer a great commitment-to-reward ratio.

Like all other crypto trading strategies, every swing trade starts with a cryptocurrency pair selection. Next comes a proper analysis of the asset’s historical price movements. The traders’ aim is to use TA in order to determine potential entry and exit points.

Other Noteworthy Trading Strategies for Crypto

By combining the above-outlined strategies, you can create your unique tactics. But before you take off and start putting these top crypto trading strategies into practice, you ought to learn about three other alternatives.

Arbitrage, High-Frequency Trading, and Index Investing

These are not your typical basic crypto trading strategies for beginners! Thus, we only recommend these strategies to more experienced crypto traders.

Each of these strategies comes with its own set of advantages and challenges, making it essential for traders to thoroughly research and practice in a risk-controlled environment before implementing them in the live crypto market.

- Arbitrage: Arbitrage involves taking advantage of price differences for the same cryptocurrency on different exchanges. Buy low on one exchange and sell high on another to profit from the spread.

- High-Frequency Trading (HFT): HFT is a strategy that relies on automated algorithms to execute a large number of trades in a short timeframe. It requires advanced technical knowledge and specialized software.

- Index Investing: Index investing involves creating a diversified portfolio of cryptocurrencies that mirrors a particular index, such as the S&P 500 for traditional stocks. This strategy offers broad market exposure and reduced risk. Out of the three above, this one is popular among beginners and experienced investors.

The Benefits of Crypto Trading

As you can imagine, any type of trading has several pros and cons. However, when it comes to the benefits of crypto trading compared to trading traditional assets, there are two major upsides. And that’s what we’re about to focus on in this section.

Extreme Volatility and Price Moves

Of course, extreme volatility and large price moves can be a major downside if you approach crypto trading in the wrong manner. However, with proper knowledge and top-notch tools in your corner, these two elements of the crypto markets offer unparalleled opportunities.

Even Bitcoin still offers those benefits; however, to exploit the true potential of extreme volatility and price moves, you ought to focus on altcoins!

Did you know that the average altcoin tends to increase by 50x – 70x during a bull market? In fact, many tokens can make even larger moves – we’re talking about 100x, 1,000x, and even more.

Plus, the 2023 memecoin season reminded us that such large profits are not exclusive to bull markets. After all, we’ve seen the PEPE token perform a massive 100,000x-plus rally in just 23 days.

24-Hour Trading

Aside from offering a much larger volatility and price moves, crypto markets have another major advantage over traditional markets – they are always open. Crypto markets never sleep, so anyone with an internet connection can access them 24/7.

Mistakes Beginners and Pros Make When Trading Crypto

Both beginner and professional crypto traders fall or have fallen into various trading pitfalls. However, three hurdles stand out: FOMO, scams, and lack of time.

- FOMO – The fear of missing out (FOMO) is enhanced in crypto due to the volatile nature and extreme price swings of crypto assets. Furthermore, FOMO is the reason why many novice traders enter the markets near the top. However, even experienced traders are not immune to FOMO. They might overextend themselves by investing too much in a rapidly rising asset, neglecting proper risk management.

- Scams – Blockchain tech has been around for more than a decade. However, its applications, including cryptocurrencies, are still poorly regulated. On the one hand, this means great opportunities, but on the other hand, this also opens up a window to bad-faith actors looking to snatch your money. Scams such as rug pulls and exit scams are pretty popular.

- Lack of Time – The fast-paced lifestyles of the 21st century leave most of us with little to no free time. As such, unless traders can go full-time crypto, they miss out on many opportunities. After all, in crypto, opportunities tend to come and go fast.

Fortunately, there’s a tool that allows you to overcome these challenges of crypto trading. In fact, Moralis Money’s core features address FOMO, scams, and lack of time by design!

Not only does Moralis Money provide free crypto trading strategies through its blog content and premium newsletter via Altcoin Advantage, but its core features act as the best crypto trading strategies! And it all starts by running Token Explorer!

3 Essential Crypto Trading Strategies You Must Know

The following are not common crypto trading strategies for beginners or pros. Instead, they are essential strategies provided exclusively via Moralis Money that you should add to any of the tactics mentioned above, especially if you plan on trading altcoins!

By deploying the following top crypto trading strategies, you’ll automatically overcome the three challenges or thieves of crypto profits:

- Using Token Explorer to find tokens before they pump. This tool allows you to spot tokens based on their real-time, on-chain metrics early. This strategy applies to new tokens as well as to more seasoned alts that have found new levels of support and are ready to go for new highs.

- Using Token Shield to minimize the risk of trading scammy tokens. Trading is risky enough by default, and you really don’t want to deal with scams on your journey. Fortunately, Moralis Money’s Token Shield feature allows you to create strategies that automatically exclude potentially scammy tokens.

- Using Token Alerts to automate the process of finding the best crypto opportunities. Thanks to Moralis Money’s Token Alerts, you can overcome the lack-of-time obstacle. On the one hand, this powerful feature allows you to run Token Explorer strategies on autopilot and detect whenever a new opportunity presents itself without going full-time crypto. On the other hand, this feature also allows you to keep a close eye on specific tokens and be notified when their core metrics hit specific levels. Hence, you get to enter or exit your positions with confidence at the best possible time.

The above three steps are also known as the three essential crypto trading tips!

Moralis Money – Top Crypto Trading Strategies at Your Fingertips

It’s worth pointing out that you can get going with Moralis Money for free. However, if you want to go beyond the basic crypto trading strategies, you’ll want to opt for the Starter or Pro plan. After all, they are your ticket to accessing all the lower timeframes and, in turn, gaining the ultimate edge!

Using Token Explorer is easy, and you can master it by visiting the Token Explorer page and start running your strategies. Or, you can use the interactive widget below to generate your first dynamic list of tokens with potential.

Don’t forget to use this interactive widget to run your first Token Explorer strategy:

Best Crypto Trading Strategies for Beginners and Pros – Key Takeaways

You now know all the basic crypto trading strategies as well as the more advanced ones. Here’s a list of the most popular crypto day trading and long-term strategies:

- Range trading

- Scalping

- Momentum trading

- HODLing

- DCA

- Swing trading

- Arbitrage

- High-frequency trading

- Index investing

You also learned that high volatility, in combination with extreme price moves and 24/7 markets, are the main two advantages of crypto markets over traditional ones. Plus, you now know that you must do all you can to overcome FOMO, scams, and lack of time.

Fortunately, Moralis Money helps you with that by deploying the three top crypto trading strategies. So, it all starts by accessing Token Explorer, applying some search parameters, and hitting the “Run Strategy” button.

Aside from using the above video to help you get going with Moralis Money, we offer many useful articles and guides to help you become a successful crypto trader. Some great examples include our guides on how to find the next coin to blow up, using the best tool for crypto day trading, and finding high-volatility crypto.