Moving forward, we will first explain what crypto pump and dump scams are. We’ll also do our best to answer whether or not pump and dump crypto hustles are, in fact, “scams.” Next, we’ll look at some examples, including the recent PEPE3.0 scheme. By looking at clear examples, you can take your understanding of these frauds to the next level.

Then, we’ll take a closer look at some key indicators that will help you spot crypto pump and dumps in the future. Last but not least, we’ll take a closer look at how Moralis Money – the ultimate on-chain analysis tool – can help you stay safer when investing in crypto. After all, being extra vigilant, especially when buying newer tokens, is important for your risk management!

Understanding Crypto Pump and Dump Schemes – What are They?

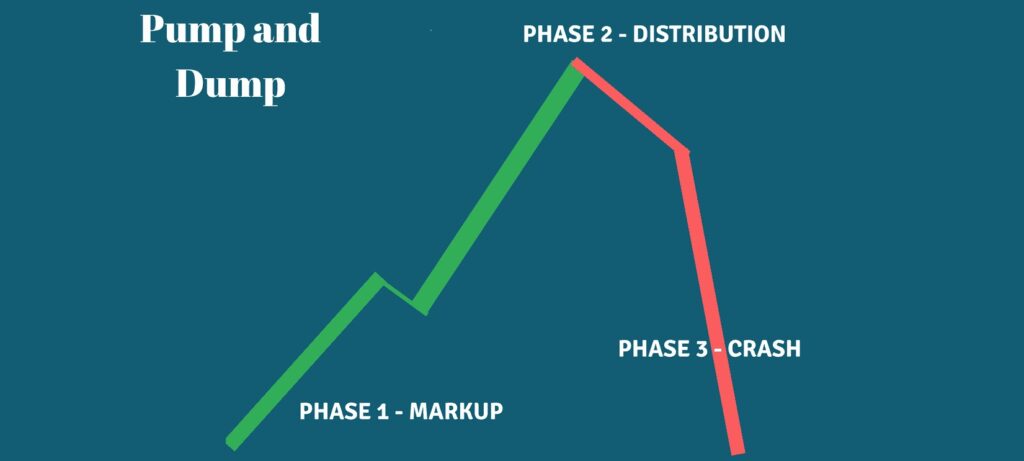

So, what are crypto pump and dump scams? They are usually projects or crypto assets in which the core team or a major holder (or holders) first uses their resources and influence to increase the price of an asset. That is the “pump” part. Then, they suddenly sell all their tokens, which is the “dump” part.

Even pump and dumps hustles come in different shapes and forms. So, let’s look at the most common ones.

Core Team Organized Scams

We’d say that the most “dirty” ones are performed by crypto project teams right from the gate. After all, these types of scams horrifically abuse the trust of people.

It all starts with the launch of a new project, which is usually just a simple fungible token. The intent of pulling off a scammy maneuver is there from the start. In these situations, a core team (or even just a single player) pre-organizes all the necessary aspects to execute the dump successfully.

As for the pump, they can initiate it just by buying a large bag of tokens themselves, as this tends to pump the price. Following the initial increase in price, FOMO kicks in for other traders seeing the initial boost, and an even larger pump can happen naturally. Of course, scammers can also use various marketing strategies to get initial traction.

Typically, the more funds these types of scammers have, the easier it is for them to create the initial pump. Proper marketing also makes the project look legit, which further tricks the buyers.

Other names for these types of crypto pump and dumps con tricks are “exit scams,” “rug pulls,” and “soft rug pulls.” In these cases, the team usually also removes the liquidity of the entire asset.

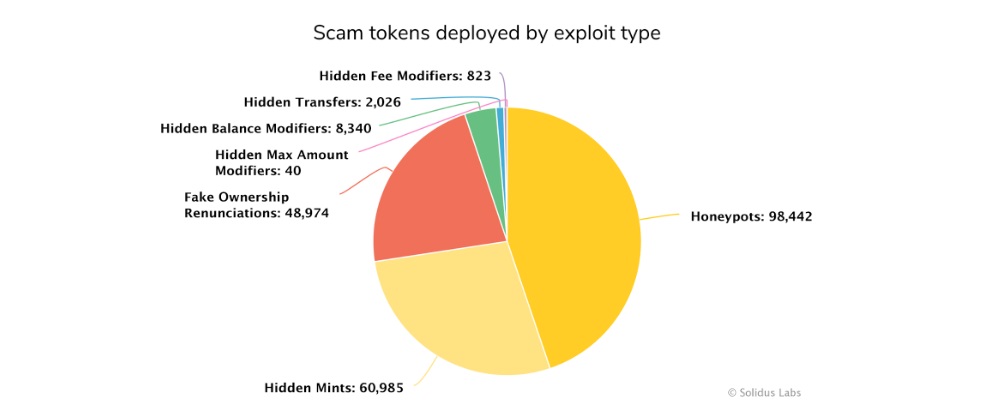

Other names for these types of crypto pump and dumps con tricks are “exit scams,” “rug pulls,” and “soft rug pulls.” In these cases, the team usually also removes the liquidity of the entire asset. But there are also so-called “hard rug pulls,” also known as “DeFi scams.” These projects automate scamming into tokens’ smart contracts. The most common exploits come in the form of “honeypots” and “hidden mints.”

Many scammy projects combine soft rug pulls and hard rug pulls to really hit investors hard.

So, when it comes to core team organized scams, the projects normally die and go to zero as soon as or shortly after the massive dumps take place.

What are Pump and Dump Groups?

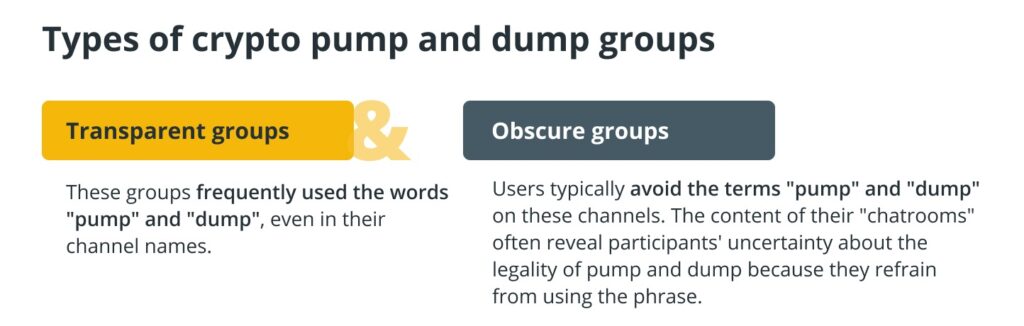

Crypto pump and dump groups are groups of crypto traders that agree to organize special trades in order to first get the price up. Then, by selling their bags, they cause the price to fall.

There are many individual whales (crypto users with large holdings) and even organized groups of whales working together. If they decide to use a new crypto project for their shenanigans, the result can be a lot similar to the above-outlined instances. However, the major difference here is that the core team is not in on it.

So, if the team sticks around, these types of projects can survive, especially if the project had previously locked its crypto asset’s liquidity.

The “Pump and Dump” Nature of Cryptocurrencies

If you plan on trading crypto assets, particularly assets with smaller market caps, you need to be aware of the nature of such crypto assets.

In general, whatever market you consider (even traditional assets), every exponential price increase will be followed by a large price pullback. So, the former is usually labeled as a “pump” and the latter as a “dump.” But since price action is a lot more volatile and tends to happen much faster in the crypto sphere, these types of moves become more obvious. Moreover, you can spot them on various timeframes.

If you look at weekly price charts of even relatively reputable altcoins, you can clearly see the “pump” and the “dump.” You can even spot this nature in Bitcoin.

So, this is the two-edged sword of the crypto markets – there are great opportunities to the upside as well as to the downside. Hence, it is extremely important to do all you can to ensure you have the ultimate edge that will help you get your timing right. And, by the way, that’s exactly Moralis Money’s specialty. But more on that later on.

The crypto pump and dumps for legit assets never kill the asset in question. Plus, after the move, the price typically finds new support at a higher price (at least on some timeframes). Essentially, just keep in mind that not every price action is a scam.

Are Pump and Dump Crypto Scams Illegal?

“It’s complicated” is the most accurate answer we can currently provide. Crypto adoption and official regulations and rules are at different stages across the globe. Yet, at the same time, anyone from anywhere with internet access (and, in some cases, a VPN service) can take part in all crypto markets. So, when it comes to marking something as “illegal” according to official laws, it is very tricky.

Plus, make sure to keep in mind that we are not legal experts ourselves!

If we consider the organized crypto pump and dumps scams by core teams, we dare to say that a large majority of people all across the globe would agree that this sort of activity is illegal. However, it’s highly likely that in certain countries, there’s no official law addressing that type of action.

However, as soon as we move over to groups, we already step deep into the gray territory. If they use false claims on their social accounts and in their marketing strategies, that could fall under the “illegal” umbrella. However, if they are just traders or even whales joining the forces to trade an asset, there is nothing illegal about that, right? After all, how is that different from the large capital funds trading traditional markets? As long as there’s no inside trading, everything goes.

All in all, it all comes down to protecting yourself! Primarily, you need to decide what risks you are willing to take. For instance, if you want to benefit from the potential upside of newly minted coins, you need to learn to maneuver around the scammy projects skillfully. Reading this article is a great first step.

Examples of How Pump and Dumps in Crypto Work – Exit Scams and Rug Pulls

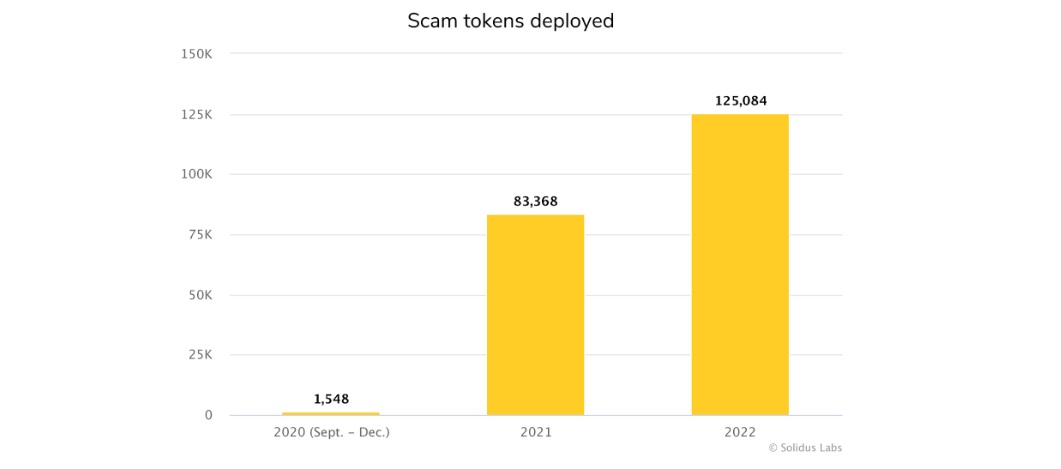

The crypto industry has seen many exit scam projects to this day. And unfortunately, several new scammy projects are launched on multiple chains daily.

Plus, a memecoin season, like the one in 2023, further complicates things. On the one hand, it inspires many folks to start creating new meaningless tokens. On the other hand, it induces FOMO in traders who see several coins increase by more than 100x in just a matter of days. With that in mind, make sure to use the best possible crypto monitoring tools and tactics to stay as safe as possible!

If you are interested in exploring some of the largest pump and dump crypto scams further, use the following list:

- OneCoin (2014 – $4 billion)

- Africrypt (2021 – $3.6 billion)

- GainBitcoin (2018 – $3 billion)

- PlusToken (2018-2019 – $2.25 billion)

- Wirecard (2020 – $2.1 billion)

- BitConnect (2021 – $2 billion)

- Thodex (2021 – $2 billion)

It’s worth pointing out that most of the largest crypto pump and dumps listed above wouldn’t classify as actual DeFi projects. For instance, Thodex was a popular Turkish centralized cryptocurrency exchange.

By some definitions, the FTX fiasco could also be included in that list, which would come at the top, with over $12 billion lost. More typical DeFi rug pulls include Meerkat Finance, AnubisDAO, Compounder Finance, and Uranium Finance.

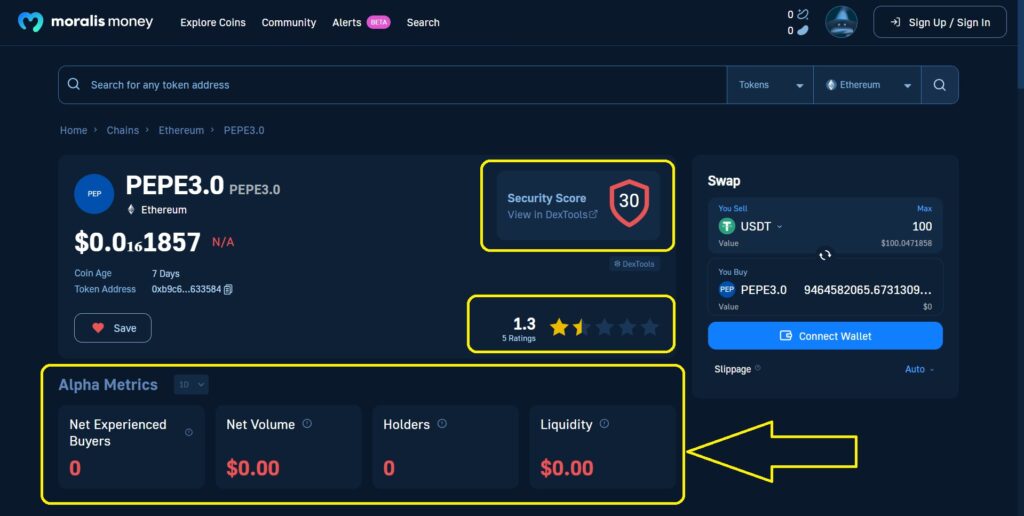

Still, in most instances, as a low market cap token investor, you’ll be exposed to much smaller projects. A great example of that would be one of the latest “PEPE3.0” projects. Just look at this token’s price chart:

How Do You Recognize a Potential Pump and Dump in Crypto? Key Indicators

When it comes to massive CeFi crypto projects (CEXs or other decentralized platforms), it is pretty hard or often nearly impossible to detect that they are scams. That is why they are often able to steal such large amounts. So, to avoid these kinds of scams, it’s best to minimize the use of CEXs. That said, when you do have to use them, make sure not to leave large amounts of crypto assets there.

As for DeFi trades and investments, a simple fundamental analysis (FA) and a closer look at real-time, on-chain data can tell you a lot.

Plus, following these basic guidelines will help you stay on the safer side:

- Avoid projects with no liquidity locked.

- Stay clear of tokens with limits on sell orders.

- Tokens with limited holders and skyrocketing price movement should be a warning flag.

- Avoid projects with suspiciously high yields.

- Approach projects with no external audit with extra caution.

Another tip is to check the project’s team and see if it’s doxxed. Furthermore, stay clear of projects with anonymous teams; however, we cannot stand behind that tip, at least not fully. After all, by following that tip, no one would have entered Bitcoin, none of the latest meme coins, or even the PEPE token that rallied more than 100,000x in just 21 days.

Fortunately, there is a way to reduce the risk of the crypto pump and dump scams even when exploring meme coins! It comes in the form of the best blockchain analytics tool – Moralis Money!

How to Spot Crypto Pump and Dump Scams Using Moralis Money

Let’s refocus on the PEPE3.0 scams mentioned earlier. For starters, these projects should have raised several yellow, if not red, flags:

- It was a meme coin with “3.0” in its name – an indication that it is a third version of “PEPE” – a clear “replica” alert.

- The project didn’t have an official website or socials.

- It was launched under the same token symbol as another previously launched token on the same chain.

But the best indicator would be Moralis Money’s red-coded shield icon:

The above image indicates Moralis Money’s token page for the scammy PEPE3.0 token. However, you can access these types of pages for all tokens on all leading chains that Moralis Money currently supports. As such, you can conduct proper research for coins to determine whether or not they are scams.

You can access these pages via the “Search” option by simply pasting a token’s address in the search field:

Or, by clicking on a token’s name from one of the dynamic lists of altcoins you can generate:

Tips on How to Reduce the Risk of Entering Crypto Scams

So, how can you avoid pump and dump crypto projects with Moralis Money? Simply follow these guidelines:

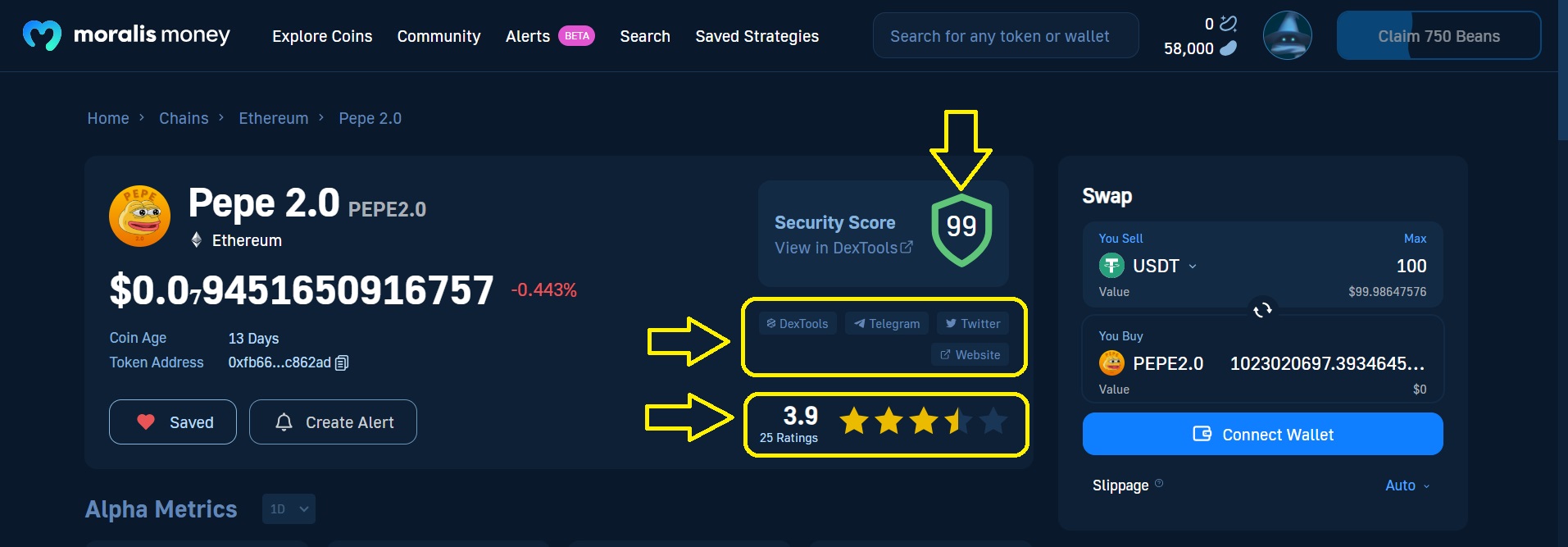

- Focus on tokens with green shields and as close to the 99 security score as possible.

- If other users have rated the token with less than three stars, be extra cautious.

- Make sure that the project has an official website and social page.

- Visit the project’s official website and make sure it has some unique features and that it looks professional.

- Visit the project’s socials and see if the team is active (regular posts) and engaging, and if it already has some legit followers (perhaps larger accounts you trust).

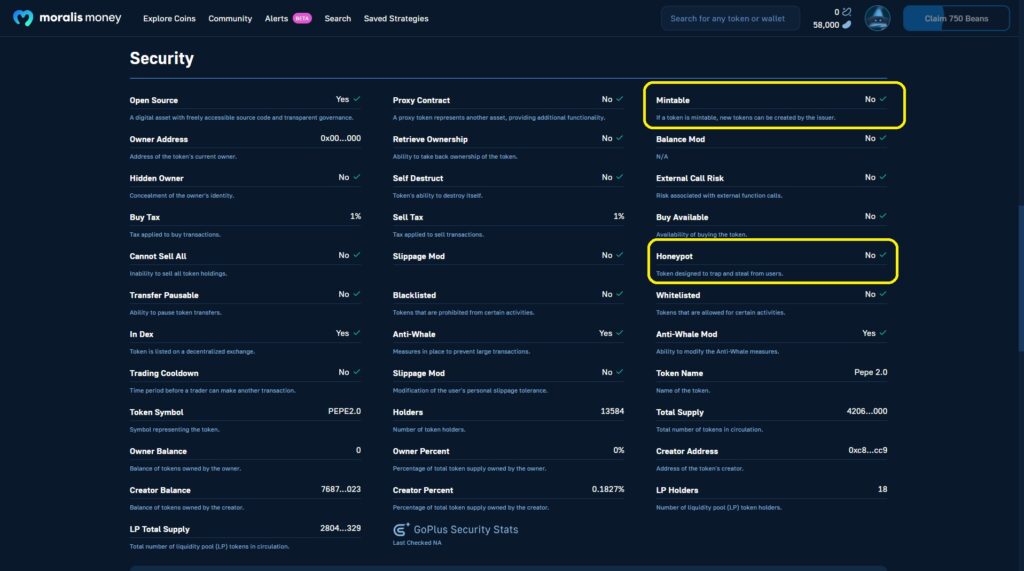

- View the “Security” section, which considers the token’s smart contract. Ideally, there should be no red crosses. But especially, make sure that “Mintable” and “Honeypot” have green checkmarks:

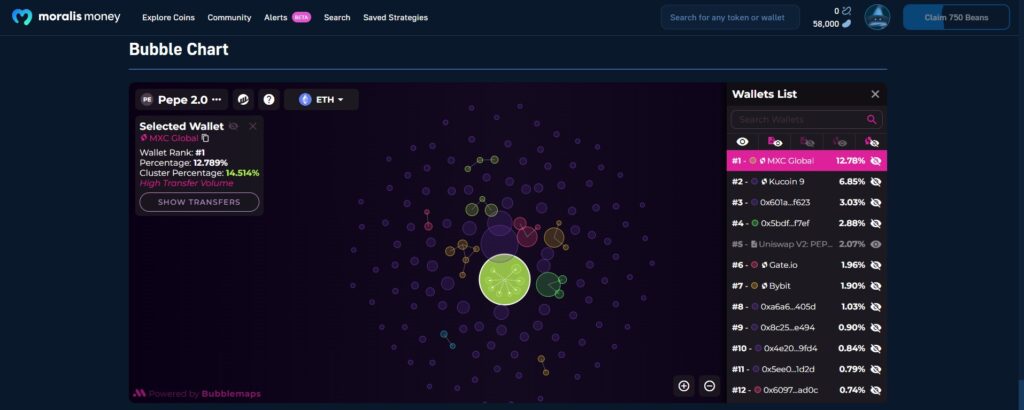

- Look at the token’s bubble chart and make sure there’s no single non-exchange address holding more than 3-5% of tokens:

Use Real-Time, On-Chain Data to Time Your Trades Effectively

Once you’ve researched the token following the above steps and you feel it matches your risk tolerance, you can determine if now’s a good time to buy it. This is where on-chain metrics enter the picture!

Since on-chain activity always precedes price action, you can use it to time your entries a lot more effectively. Finally, you can get your timing right!

So, make sure to explore the token’s real-time, on-chain metrics on different timeframes. If the token is getting on-chain momentum, the price will follow to the upside. On the other hand, if the token is losing on-chain traction, the price will move to the downside.

Of course, also look at the token’s price and make sure that you are not entering at a local top. Instead, look to enter at the points where the token has pulled back and found new support at one of the previous resistance levels:

For more details on how to make the most of Moralis Money, check out our three essential crypto trading tips. Plus, find out how to easily use Moralis Money also as the best crypto swap platform to execute your trade right on the spot!

Pump and Dump Schemes in Crypto- Summary

In today’s article, we covered quite a distance! First, you had a chance to learn what crypto pump and dump scams are. We explained the core characteristics of rug pull projects, and you also learned what crypto pump and dumps groups are. We even explained the complexity behind if these scams are illegal or not. Then, we listed some of the largest crypto exit scams – it turns out that you should be particularly vigilant when it comes to centralized projects, such as new CEXs.

Furthermore, we provided you with key indicators that will help you spot potential crypto pump and dumps. Last but not least, we offered some clear tips on how to use Moralis Money to reduce your risk. You now know that conducting research is key, and with Moralis Money, you can do it all in one place.

So, use this article – put the obtained knowledge and tips to practice and stay safe!

Keep in mind that taking some risk is part of the high-risk, high-reward altcoin trading game! So, it’s that much more important to spot the best altcoin opportunities early. And, that privilege is reserved for Moralis Money Pro users!