As we dive into the core of today’s article, we’ll first cover the basics by answering the question, “What is Loom Network?” As we do so, we’ll also explain when this crypto project began and what its history looks like. You’ll also learn who’s behind the project and how much Loom raised in their ICO. Next, we’ll focus on this project from a development perspective. As such, we’ll also explain what the project is doing to help new blockchain developers. You’ll also learn what the Loom SDK is all about.

Moving forward, we’ll shift our attention to the Loom Network coin. We’ll explain what the LOOM crypto is, look at its tokenomics, and reveal how LOOM coins are produced. Then, we’ll focus on our $LOOM price analysis. Hence, we’ll go over the asset’s historical price action and use TA basics to chart all the important levels. Plus, we’ll also share a speculative Loom Network price prediction.

Nonetheless, you’ll find out how to use the power of Moralis Money to determine whether or not the Loom Network coin is a good investment. Lastly, we’ll also explain where to buy LOOM crypto and how to buy Loom Network tokens.

What is Loom Network (LOOM)?

Loom Network is a multifaceted interoperative platform tailored for high-performance dapps seeking rapid and seamless user interactions. According to the project’s official website, LOOM empowers dapp developers to provide a user experience akin to conventional applications. The project further outlines that its tech eliminates the need to download cryptocurrency wallet software.

The project features integrations with prominent blockchain networks, including Bitcoin, Ethereum, BNB Smart Chain, and Tron, with plans to include EOS and Cosmos in the near future. This enables developers to seamlessly incorporate assets from various major chains and create dapps that are accessible across multiple platforms with a single development effort.

However, we cannot answer the question, “What is Loom Network?” without examining the project’s history.

Loom Network History – When Did Loom Network Start?

The Loom Network’s inception dates back to 2017, which can also be seen on the project’s X (formerly Twitter) account:

However, the project actually went live in 2018. Initially, the project focused on the Ethereum blockchain but later expanded to work with other blockchains. The project’s primary goal, since the beginning, was to provide developers with tools and infrastructure to create dapps, Web3 games, and other applications that could scale more efficiently and cost-effectively.

Here are some key features and components of the project:

- The Loom SDK: This software development kit provided tools and resources for developers to create dapps that could run on multiple blockchains. It aimed to address some of the scalability issues that Ethereum faced, such as high gas fees and slow transaction times.

- Loom PlasmaChain: Loom introduced a concept called “PlasmaChain,” which was a sidechain that connected to the Ethereum mainnet and allowed dapps to offload transactions from the Ethereum network to reduce congestion and costs.

- DPoS Consensus: Loom Network utilized a delegated proof-of-stake (DPoS) consensus mechanism to achieve faster transaction confirmations and scalability. DPoS involves a smaller number of validators chosen by token holders to confirm transactions. This can lead to quicker consensus compared to traditional proof-of-work (PoW) or proof-of-stake (PoS) mechanisms.

- LOOM Token: The native cryptocurrency of Loom Network is the LOOM token. It was used for various purposes within the network, including staking, transaction fees, and as a means of exchange.

It’s worth noting that in early 2020, the Loom shortly rebranded to “Loom Network 2.0” and shifted its focus towards creating blockchain-based games and social applications. However, the project faced some challenges and changes in direction over time, including the Loom Network coin (LOOM) smart contract migration in January 2021.

Who is Behind Loom Network?

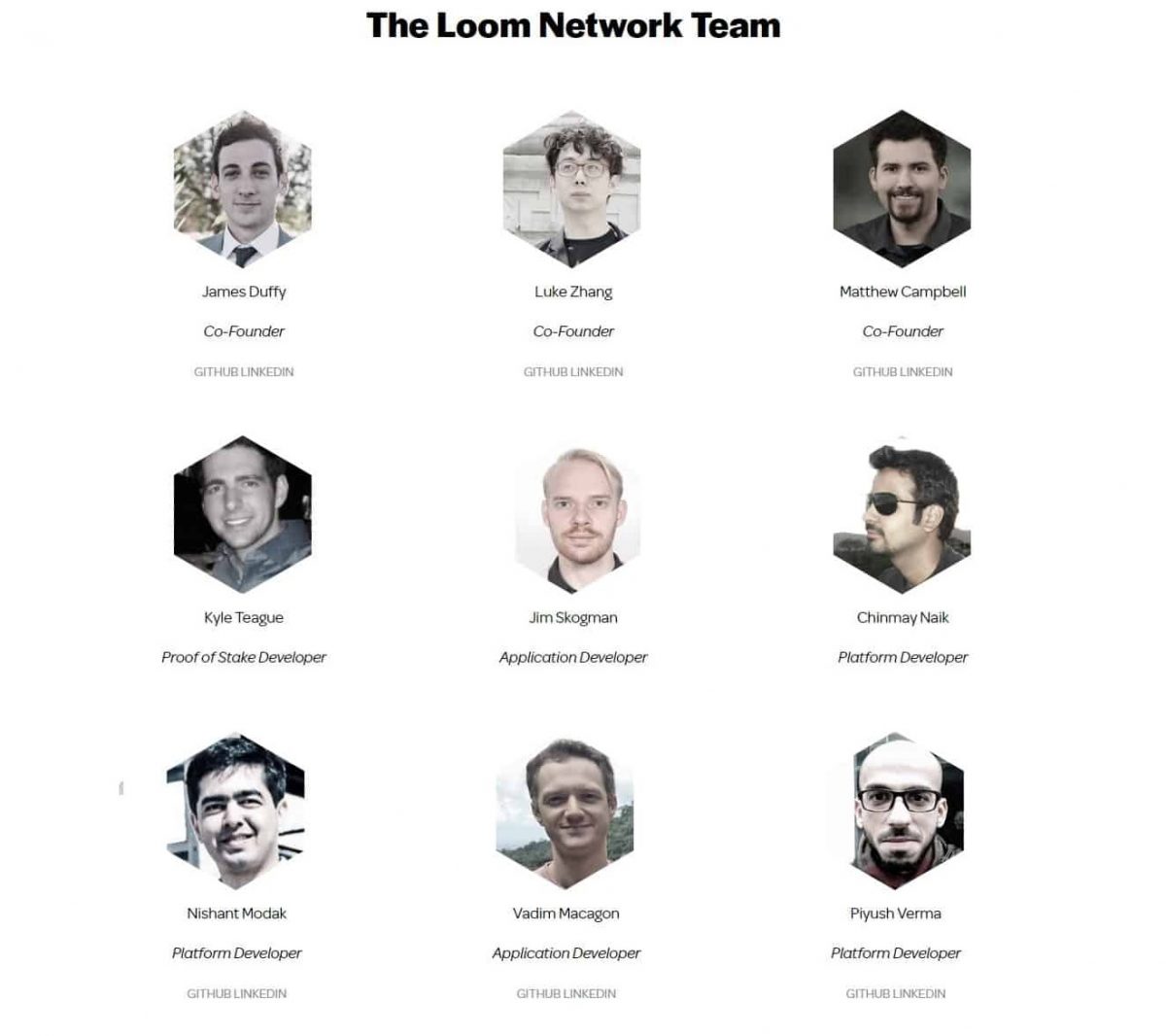

Loom Network was founded by a team of individuals with a background in blockchain and tech. The three co-founders of Loom Network are:

- James Duffy played a significant role in the project. He had experience in blockchain technology and was actively involved in the development and promotion of Loom Network.

- Matthew Campbell contributed to the project’s vision and development, particularly in the context of creating a platform for scalable decentralized applications.

- Luke Zhang also played a key role in the project, helping to establish the technical aspects of the platform.

These co-founders worked together to bring the project to life. Since the project’s inception, they aimed to address scalability issues and provide tools for developers to build efficient decentralized applications (dapps). The above screenshot depicts the Loom Network team at the time of the project’s launch in 2018. As for the current team, the LOOM official website doesn’t offer any details.

How Much Did Loom Network Raise in ICO?

Back in the 2017 crypto bull market, ICOs were a huge thing. As such, Loom Network capitalized on the “ICO trend” by launching its native crypto. According to ICO Drops, the project’s token sale ended on January 10, 2018, by reaching 80% of the $57 million goal. So, Loom Network raised $45,810,000.

It’s worth noting that at the time of the Loom Network coin’s sale, BTC was already in a downtrend following its peak in December 2017. This fact affected the entire crypto market, including the Loom Network price prediction at the time.

Loom Network Development

The project remains true to its initial aim. Unlike many projects that died and stopped evolving during various bear markets, the Loom SDK survived.

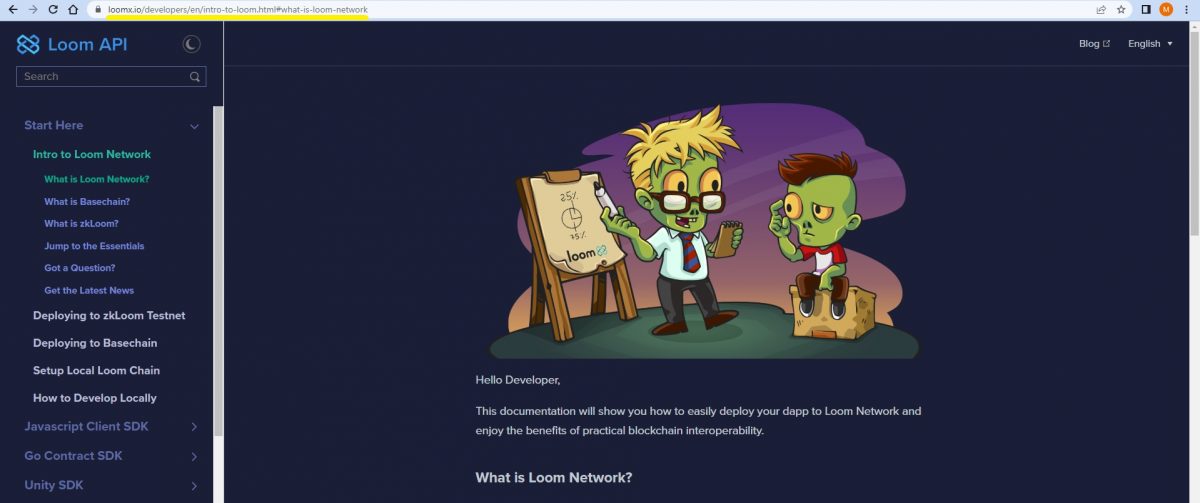

Along the way, the project evolved and added some new features, such as zkLoom. As part of the evolution of LOOM’s PlasmaChain, the project now offers Basechain. If you want to learn more about Basechain or zkLoom, make sure to visit the project’s documentation:

As you can see in the above screenshot, the Loom API documentation offers all the details devs need to get going with the Loom SDK. The simplest way to access these docs is to hit the “Developers, Start Building Now” button on the “loomx.io” website. This is also where the project lists the following argument for why developers love Loom:

- Production-ready today

- Fast and scalable for serious dapps

- Frictionless user experience

- Access to a massive user base

- Top-notch security

- Future-proof your dapp

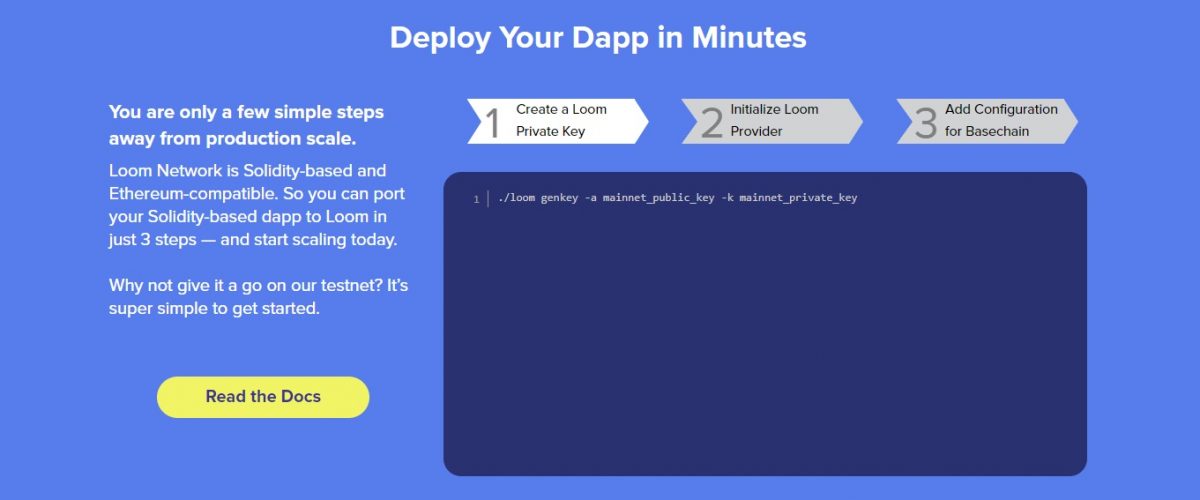

Furthermore, the project’s official website also claims that devs can deploy dapps in minutes with Loom:

What is Loom Network Doing to Help New Blockchain Developers?

At the time of writing, Loom Network is working on launching the zkLoom mainnet. This Ethereum layer-2 solution will be the platform’s second option to deploy dapps. However, devs can already work on the zkLoom testnet. So, for deployment purposes, devs using the Loom SDK get to use the Basechain network.

Moreover, the Loom SDK is split into JavaScript client SDK, Go contract SDK, and Unity SDK to serve different purposes. Again, for more details, refer to the abovementioned documentation.

Another great thing that Loom Network is doing to help new blockchain developers comes in the form of free education. To that end, Loom created the CryptoZombies (CZ) code school for learning to build Ethereum dapps:

Overall, Loom Network looks quite promising as a dapp development tool. So, if that interests you, make sure to visit the project’s documentation. However, we haven’t tried their tools ourselves and cannot confirm or refute the Loom Network website’s claims.

On the other hand, we can confidently back the ultimate Web3 API provider – Moralis. After all, this is the tool that powers Moralis Money. So, if you are ready to make Web3 development as easy as Web2, make sure to check out Moralis’ Web3 data tools today!

LOOM Crypto Analysis

If you covered the above sections, you already know the Loom project has its native Loom Network coin, LOOM. You also know that the token launched in January 2018 via an ICO, where it accumulated just shy of $46 million.

Now, before we proceed with our Loom Network coin price analysis and offer a Loom Network price prediction, let’s take a closer look at the LOOM crypto. After all, this “What is Loom Network” article wouldn’t be complete without some details about $LOOM.

What is the LOOM Cryptocurrency?

The LOOM token serves a dual purpose within Loom Network’s ecosystem. Primarily, it operates as a proof-of-stake token, bolstering the security of Basechain, Loom Network’s mainnet. LOOM holders can actively participate by staking their tokens, contributing to the network’s integrity, and reaping rewards in return.

Additionally, developers find utility in LOOM as it enables them to cover the costs of dapp hosting on Loom Network. Unlike Ethereum’s fee structure, Loom Network adopts a more developer-friendly approach, allowing dapp creators to pay a fixed monthly fee for hosting. This approach eliminates the need for end-users to shoulder transaction expenses, enhancing the overall dapp experience.

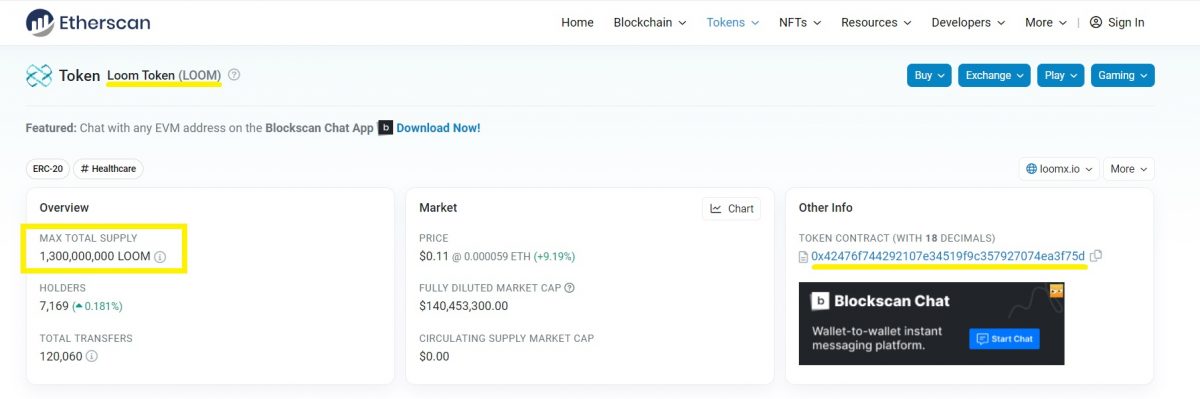

Loom Network (LOOM) Coin Tokenomics

- Symbol/ticker: LOOM or $LOOM

- Network: Ethereum and BNB Smart Chain

- Token type:

- ERC-20 (Ethereum)

- BEP-20 (BNB Smart Chain)

- Smart contract address:

- 0x42476F744292107e34519F9c357927074Ea3F75D (Ethereum)

- 0xe6ce27025f13f5213bbc560dc275e292965a392f (BNB Smart Chain)

- Total supply:

- 1.3 billion $LOOM

- ~1 billion tokens are in active circulation on Ethereum

- ~130 million are in active circulation on BSC.

- LOOM is mintable and doesn’t have a maximum total supply

- 1.3 billion $LOOM

How are LOOM Coins Produced?

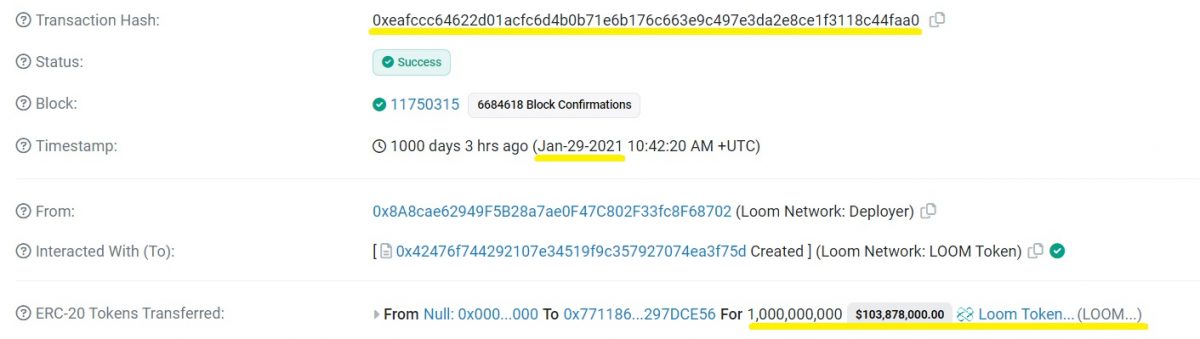

As indicated by the Etherscan details below, 1,000,000,000 of the current LOOM crypto tokens were minted on January 29, 2021, during its smart contract immigration event:

However, generally speaking, Loom Network coins are not produced through traditional mining processes like some other cryptocurrencies. Instead, LOOM coins are created through a method called “staking.”

Network validators and delegators (individuals who delegate their LOOM coins to validators) receive rewards for their participation in the network’s security. These rewards often come in the form of additional LOOM coins distributed based on the number of coins staked and the duration of staking.

Furthermore, the network’s protocol may include an inflation mechanism, which generates a set number of new LOOM coins in each block. These new coins are typically distributed as rewards to validators and delegators. This controlled inflation is used to incentivize network participation and maintain security.

Loom Crypto Price Analysis

Let’s now look at the price of the Loom Network coin. Due to the long history of $LOOM, we will not be describing the token’s entire price action. However, the following chart paints a clear picture:

As mentioned previously, Bitcoin was already in a clear downtrend following its 2017 peak when $LOOM started to trade. However, BTC went on a 40% run in the spring of 2018, which spurred LOOM’s largest rally. The latter resulted in the token’s all-time high (ATH) price of $0.77-ish, which was set on May 4, 2018. But following that peak, the Loom Network coin price came down with the rest of the crypto market. It set its all-time low (ATL) on March 13, 2020, at $0.0076-ish.

Despite some optimistic Loom Network price predictions for the 2021 bull run, $LOOM didn’t manage to set a new ATH. In the previous cycle, LOOM wasn’t strong enough to break above the $0.27 resistance. However, it’s worth pointing out that the asset’s price stayed higher in the 2022 bear market than it did in 2018. The price never dipped below $0.035. And it was still in that region in the first part of September 2023.

However, on September 9, 2023, $LOOM started an impressive 1,100%-plus run. Thus, by October 15, 2023, the price increased more than 12-fold, reaching its high at $0.5. However, as you can see more closely in the chart below, the price didn’t stay up for long.

TA (Technical Analysis)

The latest LOOM pump and dump is a good indication that this crypto still has some gas left in its tank. Sure, most of this pump was annihilated in a matter of five days; however, the price still sits at a higher level than it did prior to the latest run.

So, as long as the $0.09-ish and $0.07-ish levels hold, LOOM could move higher. Based on TA basics, these are the levels of significance that you need to consider when making any Loom Network price prediction:

- $0.05-$0.06

- $0.09-ish

- $0.11-$0.12

- $0.14-ish

- $0.17-ish

- $0.27-ish

- $0.35-ish

- $0.39-ish

- $0.54-ish

- $0.59-ish

- $0.68-ish

Note: The above levels can vary depending on the exchange you use to look at the LOOM price. So, your decision about where to buy LOOM crypto will have some effect.

LOOM Crypto Forecast – Loom Network Price Prediction

Given the fact that $LOOM’s latest rally (presented above) crossed the token’s top of the previous cycle, we believe that a Loom Network price prediction deserves to be quite optimistic.

As such, we dare to say that if the crypto market conditions stay positive, LOOM could reach all of the above-listed levels above its current price. After all, the above “What is Loom Network” section also revealed that the project has been evolving and pushing the envelope further. Plus, the latest 30-day, 1,200% pump definitely put the token on the radar of many altcoin traders. In fact, many Moralis Money users, especially the ones on the Starter and Pro plans, were able to spot LOOM’s increased on-chain activity and caught most of this pump for some decent profits. After all, Moralis Money is the best crypto scanner that offers real-time crypto price alerts and automated crypto signals.

Based on our Loom Network price prediction, the token has what it takes to set a new ATH in the upcoming bull market. And if the token enters price discovery mode, it could go as high as $3 according to the Fibonacci retracement tool’s 4.236 extension level.

On the downside, there are some rumors that the latest LOOM pump was artificially induced by Korean traders on the UpBit exchange. If those rumors prove to be true, our Loom Network price prediction could easily turn out to be way off.

Is LOOM Crypto a Good Investment?

One thing is quite certain about the LOOM project – it has solid fundamentals. However, only time will tell if this will be enough to push the price of the Loom Network coin much higher.

All in all, you should use this article to decide if LOOM deserves your further attention. If so, you ought to use the section below and learn where to buy LOOM crypto and how to buy Loom Network tokens. However, before you do so, make sure to research the project and its native token further. And there’s no better place to do that than the Moralis Money $LOOM token page. By using the links and resources offered on that page, you’ll be able to decide if/when to buy $LOOM. In fact, using the combination of the “Price Chart” section and the alpha metrics, you’ll be able to come up with your own Loom Network price prediction.

So, use the above “$LOOM” link or the interactive widget below and decide if LOOM is a good investment for you.

Where and How to Buy LOOM Crypto?

If you decide you wish to get a bag of $LOOM, you have several options. Just use the “Market” section on CoinGecko or CoinMarketCap page for that token. There, you’ll find a list of all CEXs and DEXs that offer the relevant training pair, including the trading volume. As such, you can easily pick a market that best suits your goals.

In case you decide to buy Loom Network tokens, use the above instructions to find a DEX or CEX that has a sufficient trading volume for that crypto.

If you go with a DEX, then you’ll need a hot Web3 wallet (e.g., MetaMask), which you’ll need to connect to the platform. Next, you’ll be able to select the trading pair and execute the on-chain transaction.

The process of using a CEX is arguably even simpler. After all, once you have your account ready and funded, it is rather straightforward: simply visit that token’s trading pair and execute the trade. However, keep in mind that whenever you use CEXs, you are not in full control of your cryptos. “Not your private key, not your crypto!”

Summary: What is Loom Network? LOOM Crypto Analysis and Price Prediction

- What is Loom Network? It is a cross-chain dapp development platform, which devs can use via the Loom SDK.

- The platform utilizes its own blockchain network – Basechain. Plus, another layer-2 network – zkLoom is in the pipeline.

- Loom’s beginnings reach back to 2017.

- The project has its own native ERC-20 and BEP-20 crypto called $LOOM.

- The Loom Network coin went live in 2018 and migrated to a new smart contract in 2021.

- LOOM set its current ATH in May 2018 at $0.77-ish and its ATL in March 2020 at $0.0076-ish.

- The September-October LOOM rally took its price from $0.038 all the way to $0.5; however, the pump was short-lived.

- Our optimistic Loom Network price prediction points towards $3 for the upcoming bull run.

- To determine if/when to buy $LOOM, make sure to use the respective Moralis Money token page.

Whether you decide to buy the Loom token or not, make sure to explore other altcoin opportunities. After all, with Moralis Money’s core feature – Token Explorer – you easily find new crypto projects. Unlike other crypto analysis tools, Moralis Money presents the results of blockchain analytics in a clear and actionable manner.

With that in mind, we encourage you to start using this ultimate crypto pump detector to spot upcoming crypto projects with high potential. So, use Moralis Money to make $100 a day trading cryptocurrency and to finally make those 50x-plus altcoin swing trades.